When a company acquires another business, it is often justified by the argument that the investment will create synergies. The primary source of synergy in an acquisition is in the presumption that the target firm controls a specialized resource that becomes more valuable if combined with the acquiring firm’s resources. There are two main types, operating synergy and financial synergy, and this guide will focus on the latter.

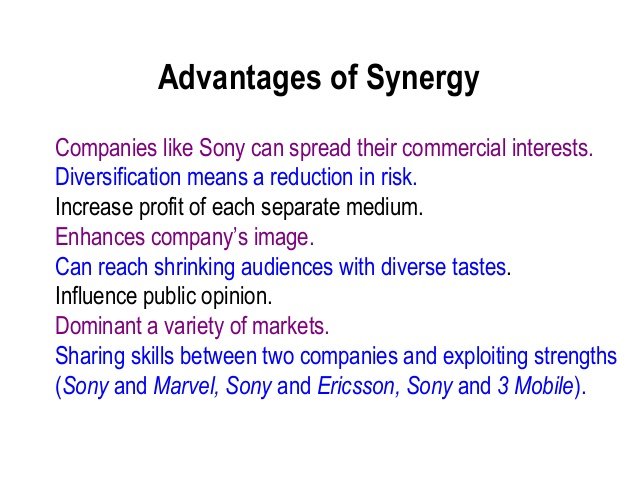

Value can be created, for example, through revenue enhancement, cost reductions, increased operating cash flow, improved managerial decision making, or the sale of redundant assets. However, the value created from proposed synergies also may have an additional investment cost as well.

Synergy takes the form of revenue enhancement and cost savings.

When two companies in the same industry merge, such as two banks, combined revenues tend to decline to the extent that the businesses overlap in the same market and some customers become alienated.

For the merger to benefit shareholders, there should be cost-saving opportunities to offset the revenue decline. In other terms, the synergies deriving from the merger must exceed the initially lost value.

As a rule of thumb, synergy is a business combination where 2+2 = 5.

Many analysts, however, do not consider these incremental investments or “hidden” costs when performing a pricing analysis or valuation of a potential target. Failure to consider the hidden costs often causes the overvaluation of a potential target, which may lead to destroying value rather than creating it.

Synergy appeared due to acquisition should include higher results then it was originally expected.

Acquisition process should be well-planned. Mark Sirower, the US leader of the Merger & Acquisition Strategy and Commercial Diligence practice, named 4 components which should take place in order to achieve successful synergies:

- Strategic vision

- Operating strategy

- Systems integration

- Power and culture

The buyer should pay out the premium to shareholders of merged company. The higher the premium, the lower the potential benefit for the buyer. Therefore, synergies should not be intangible. It should be carefully forecast and discounted from net cash flows which are feasible within the chosen time frame.

Post-merger integration issues, as well as competitors’ reactions, can contribute to the hidden costs of an acquisition.

Besides the positive impact of revenue enhancements, cost reductions, and other efficiencies, valuation analysts need to price them in, too.