Calculation of cash price refers to the process of determining the actual amount a buyer needs to pay upfront to purchase a product or asset outright, without any financing, credit, or deferred payment arrangement. It reflects the pure value of the item, excluding any added costs such as interest, administrative fees, service charges, or future installment costs.

When goods are sold under credit or hire purchase arrangements, the total amount payable over time (often called the hire purchase price) includes both the cash price and additional charges for the convenience of paying later. To calculate the cash price from such deals, one must subtract all extra costs—primarily the finance or interest component.

For example, if a buyer agrees to pay ₹30,000 over 12 months under a hire purchase deal, but the interest charges total ₹5,000, the cash price is ₹25,000. This represents the amount they would have paid if they bought the item outright in cash.

Calculation of cash price is important for accounting, taxation, and financial decision-making. It helps buyers understand the true cost of the product without borrowing costs and enables businesses to assess profit margins and set clear pricing structures. Moreover, legal agreements often require the cash price to be stated explicitly, ensuring clarity and transparency between the buyer and the seller.

In some cases, die cash price is not given. Since the assets purchased cannot be capitalized at more than the cash price, it will be necessary to find out what it is. The way to proceed is to take up die final instalment first and to deduct interest from it. Interest for one year can be found out by multiplying the sum due at the end of the year by the formula Rate of Interest / 100 + Rate of Interest.

Suppose A owes B Rs 100 the interest being 15%. At the end of one year B will have to pay Rs 115 out of which Rs 15 is for interest. Hence, 15/115 of the sum due at the end of the year will be interest. Deducting interest, the sum due in the beginning of the year can be ascertained. This will also be the amount due at the end of the last but one year after paying the annual instalment. The total of these two will give the total sum due at the end of the last but one year.

That year’s interest can again be ascertained by multiplying the total amount due by the formula:

Rate of Interest/100 + Rate of Interest

The cash price can also be calculated, if the annual payments are uniform by the formula:

Where r is the rate of interest per cent per annum and n is the number of years over which payment is to be made. This really amounts to finding out the present value of the amount to be paid or received, taking into account the concerned rate of interest. Tables are available for ready calculation.

Example:

On 1st April, 2008, Bihar Collieries obtained a machine on the hire purchase system, the total amount payable being Rs 2, 50,000. Payment was to be made Rs 50,000 down and the balance in four annual installments of Rs 50,000 each. Interest charged was at the rate of 15 per cent. At what value should the machine be capitalized?

Solution:

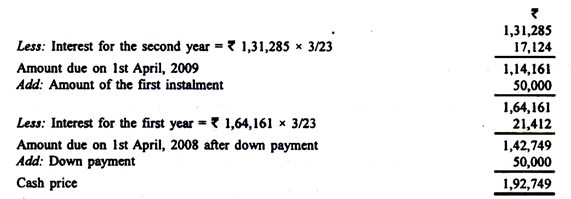

If amount due in the beginning of a year is Rs 100, interest for the year will be Rs 15 and the amount of instalment due at the end of the year will be Rs 115. Thus, interest is 15/115 or 3/23 of the amount due at the end of each year.

Keeping this in mind, the cash price of the machine can be calculated in the following manner:

Alternatively, the present value at 15% per annum of one rupee received annually at the end of four years is Rs 2-85498. Thus, the present value of Rs 50,000 is Rs 50,000 x 2.85498 = Rs 1, 42,749. To this, we add down payment of Rs 50,000. Therefore, the cash price is Rs 1, 42,749 + Rs 50,000 = Rs 1, 92,749.

3 thoughts on “Calculation of Cash Price”