1.1. A supply can be categorized as Intra- State Supply if the following conditions are satisfied:

1.1.1. The Location of Supplier and Place of Supply are in the same State or Union Territory;

1.2. A supply can be categorized as Inter-State Supply in the following situations:

1.2.1. The Location of Supplier and Place of Supply are in different State or Union Territory;

1.2.2. The imported goods till they cross the customs frontiers of India (CFI);

1.2.3. The import of services;

1.2.4. The export of goods;

1.2.5. The export of services;

1.2.6. The location of supplier in India and Place of supply outside India;

1.2.7. Supply to or by SEZ Developer/ unit;

“Location of the supplier of services” means:

(a) Where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

(b) Where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is made from more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the provision of the supply; and

(d) in absence of such places, the location of the usual place of residence of the supplier;

The place of supply for goods is defined as per section 10 & 11 and for services is defined as per section 12 & 13 of IGST Act, 2017;

1.3. The GST law does not define the location of supplier for goods. Considering that the location of supplier will be location of goods, in this type of transaction there will not be any inter- State supply since the location of the supplier and the place of supply will be in the same State.

However, the most crucial thing is to determine the Place of Supply of services or goods. The IGST law shall be referred for section 10, 11, 12 & 13 to determine the place of supply.

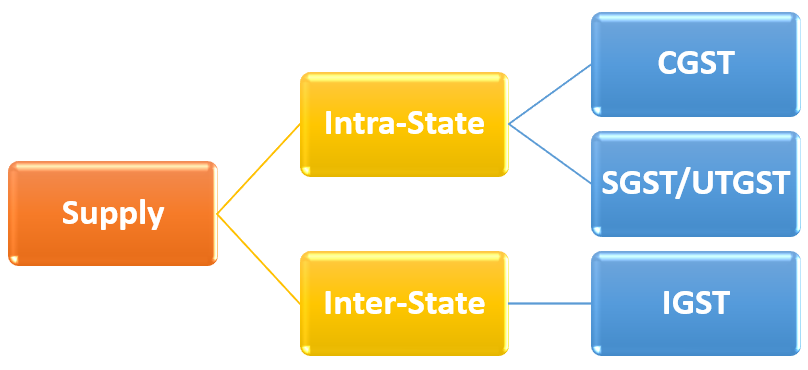

2.1. Under GST regime, 4 types of taxes i.e. CGST, SGST, UTGST and IGST. If a transaction/supply is determined as Intra- State Supply then CGST and SGST/UTGST shall be chargeable and payable whereas in case of Inter-State Supply then IGST shall be chargeable and payable.

2.2. Therefore, it is well established that different taxes is to be paid on respective supplies and it becomes more important to determine the Supply to be Intra- State and Inter-State supply.

| S.No. | Nature of business | Category of Supply | Applicable tax |

| 1 | Hotel, Inns, etc. | Intra- State Supply | CGST & SGST/ UTGST |

| 2 | Restaurants | Intra- State Supply | CGST & SGST/ UTGST |

| 3 | Import/Export of goods | Inter-State Supply | IGST |

| 4 | Import/ Export of services | Inter-State Supply | IGST |

| 5 | Renting of immovable property | Intra- State Supply (If landlord and property is located in same State) | CGST & SGST/ UTGST |

| 6 | Renting of immovable property | Inter-State Supply (If landlord and property is located in different State) | IGST |

One thought on “Computation of GST: Computation of GST under Inter State and Intra State Supplies”