Abnormal Item of Goods, if any, should be excluded at the time of preparing Trading Account. Therefore, value of such goods which affect opening stock or purchase are to be deducted. Similarly, if any abnormal item of sale is included with sales, the same is also to be excluded.

As a result, the (Memorandum) Trading Account will disclose the stock of normal line of goods at the date of fire. Therefore, the unsold value of abnormal item of goods is to be added with the normal stock in order to ascertain the total value of stock. It is better, for this purpose, to prepare the (Memorandum) Trading Account in two columns, viz., Columnar Trading Account showing the Normal and Abnormal items of goods.

illustration 1:

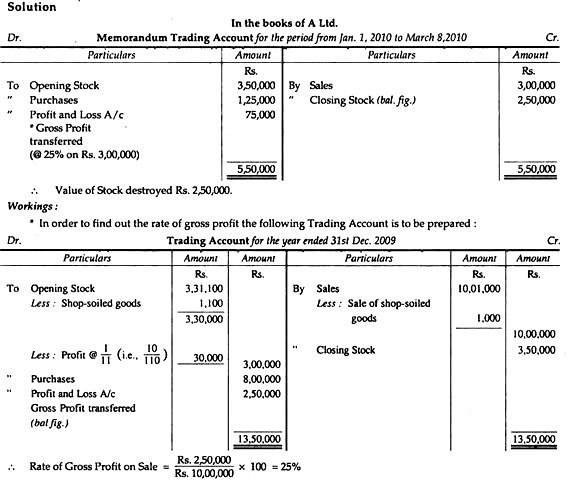

A fire occurred in the godown of A Ltd. on 9th March 2010, destroying the entire Stock. The books and records were saved from which the following particulars were ascertained:

| Rs. | Rs. | ||

| Sales for the year 2009 | 10,01,000 | Purchases for the period 1.1.2010 to 8.3.2010 | 1,25,000 |

| Sales for the period 1.1.2010 to 8.3.2010 | 3,00,000 | Stock on 1.1.2009 | 3,31,100 |

| Purchase for the year 2009 | 8,00,000 | Stock on 31.12.2009 | 3,85,000 |

The company has been following the practice of valuing the Stock of goods at actual cost plus 10%. Including in the stock on 1.1.2009 were some shop-soiled goods which originally cost Rs. 2,000, but were valued at Rs. 1,100. These goods were sold during the year 2009 for Rs. 1,000. Subject to these, the rate of Gross Profit and the basis of valuation of Stock were uniform.

You are required to ascertain the value of the Stock destroyed.

One thought on “Treatment of Abnormal Items”