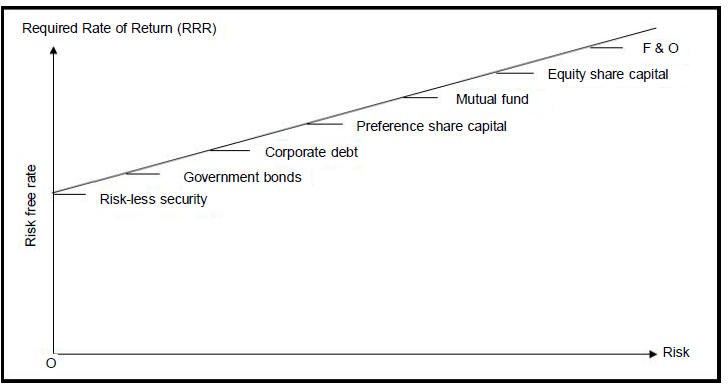

The risk of an investment refers to the variability of its rate of return from the expected rate of return. Statistically, it can be measured with variance, standard deviation, range, and beta.

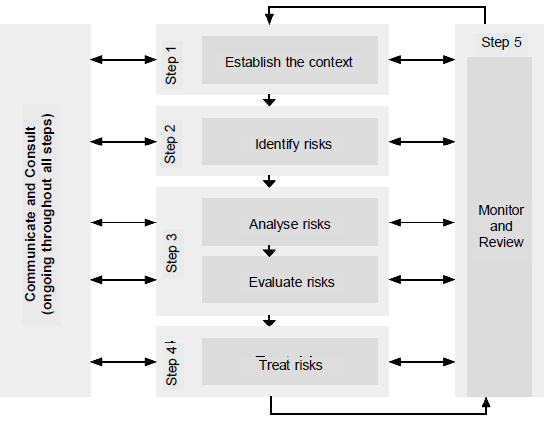

Risk Management is a five-step process:

Step 1: Establish the context

Step 2: Identify the risks

Step 3: Analyse the risks

Step 4: Evaluate the risks

Step 5: Treat the risks

Throughout each step, it is essential that there is consultation and communication with everyone

in organisation about its functions, activities and events (refer to diagram).

Step 1: Establish the Context

Before risk can be clearly understood and dealt with, it is important to understand the context in

which it exists. You should define the relationship between your club and the environment that it

operates in, so that the boundaries for dealing with risks are clear.

Establish the content by considering:

- The strategic context: The environment within which the organisation operates

- The organisational context: The objectives, core activities and operation’s of the club.

Step 2: Identify the Risks

The purpose of this step is to identify what could go wrong (likelihood) and what is the consequence (loss or damage) of it occurring.

Risks can be physical, financial, ethical or legal.

Physical risks are those involving personal injuries, environmental and weather conditions and the physical assets of the organisation such as property, buildings, equipment, vehicles, stock and grounds.

Financial risks are those that involve the assets of the organisation and include theft, fraud, loans, license fees, attendances, membership fees, insurance costs, lease payments, pay-out of damages claims or penalties and fines by the government.

Ethical risks involve actual or potential harm to the reputation or beliefs of your club, while legal risks consist of responsibilities imposed on providers, participants and consumers arising from laws made by federal, state and local government authorities.

Step 3: Analyse the Risks (& Evaluate)

This involves analysing the likelihood and consequences of each identified risk and deciding which risk factors will potentially have the greatest effect and should, therefore, receive priority with regard to how they will be managed. The level of risk is analysed by combining estimates of likelihood (table 1) and consequences (table 2), to determine the priority level of the risk (table 3).

It is important to consider the consequences and the likelihood of risk in the context of the activity, the nature of your club and any other factors that may alter the consequences of likelihood of risk.

Risk evaluation involves comparing the level of risk found during the analysis process with previously established risk criteria, and deciding whether risks can be accepted. If the risk falls into the low or acceptable categories, they may be accepted with minimal further treatment. These risks should be monitored and periodically reviewed to ensure they remain acceptable. If risks do not fall into the low or acceptable category, they should be treated using one or more of the treatment options considered in step 4.

Step 4: Treat the Risks

Risk treatment involves identifying the range of options for treating the risk, evaluating those

options, preparing the risk treatment plans and implementing those plans. It is about considering the options for treatment and selecting the most appropriate method to achieve the desired outcome. Options for treatment need to be proportionate to the significance of the risk, and the cost of treatment commensurate with the potential benefits of treatment.

According to the standard, treatment options include:

- Accepting the risk: For example, most people would consider minor injuries in participating in the sporting activity as being an inherent risk.

- Avoiding the risk: Is about your club deciding either not to proceed with an activity, or choosing an alternate activity with acceptable risk, which meets the objects of your club. For example, a cricket club wishing to raise funds, may decide that a rock-climbing competition without a properly trained and accredited instructor, equipment, etc. may be risky and may decide on a safer way of raising funds.

- Reducing the risk: Likelihood, or consequences, or both, is commonly practiced treatment of a risk within sport; for example, use of mouth guards for players in some sports (i.e. contact sports).

- Transferring the risk: In full or in part, will generally occur through contracts or notices, for example your insurance contract is perhaps the most commonly used risk transfer form used. Other examples include lease agreements, waivers, disclaimers, tickets, and warning signs.

- Retaining the risk: Is knowing that the risk treatment is not about risk elimination, rather it is about acknowledging, the risk is an important part of the sport activity, and some must be retained because of the inherent nature of the sport activity. It is important to consider the level of risk which is inherent and acceptable.

- Financing the risk: Means the club funding the consequences of risk i.e. providing funds to cover the costs of implementing the risk treatment. Most community nonprofit sport clubs would not consider this option.

Step 5: Monitor and Review

As with communication and consultation, monitoring and review is an ongoing part of risk management that is integral to every step of the process. It is also the part of risk management that is most often given inadequate focus, and as a result, the risk management programs of many organisations become irrelevant and ineffective over time. Monitoring and review ensure that the important information generated by the risk management process is captured, used and maintained.

Few risks remain static. Factors that may affect the likelihood and consequences of an outcome may change, as may the factors that affect the suitability or cost of the various treatment options.

Review is an integral part of the risk management treatment plan. As discussed earlier, risk management is an integral part of all core business functions, and it should be seen and treated as such. Risk management should be fully incorporated into the operational and management processes at every level of the organisation and should be driven from the top down.

One thought on “Definition, Risk Process”