Fixed assets of are a permanent nature with which the business is carried on and which are held for earning income and not for re-sale in the ordinary course of the business. It is a long-term tangible property that a firm owns and uses in its operations to generate income. Fixed assets are not converted into cash or consumed within a year. They are also called as Capital Assets. Example: land and buildings, plant and machinery, furniture etc. These assets are to be valued at cost price less total depreciation in their value by constant use. Additions by way of purchase and deletions by way of sales should be taken into account. The mode of valuation of different types of assets differs depending upon the nature of the business and the purpose for which the assets are held.

-

Land and Buildings

Land means a long -term asset that refers to the cost of real property exclusive of the cost of any constructed assets on the property. The value of land has an appreciated value and is not subject to depreciation. A building is a noncurrent or long-term asset which shows the cost of a building (excluding the cost of the land) Buildings will be depreciated over their useful life of the asset.

Classified into two types

Land and Buildings can further be classified as:

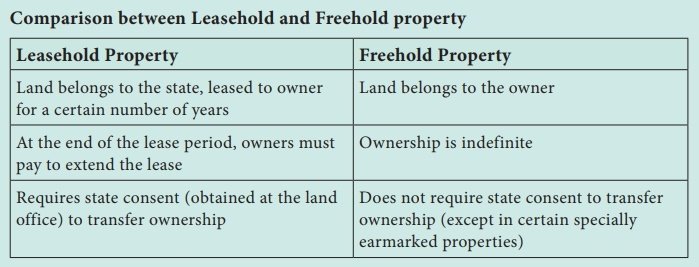

- Freehold property

- Leasehold property

(i) Freehold Property

A property which is free from hold (Possession/Rights) is called as freehold property. This means that the property is free from the hold of anybody besides the owner who enjoys complete ownership.

Auditor’s Duty

- Where Freehold property has been purchased, the auditor should examine the title deeds e.g., purchase deed, certificate of registration, the broker’s note and auctioneer’s account etc., to verify the correct position.

- When the property has been mortgaged, the auditor should obtain a certificate from the mortgagee regarding the possession of title deed and outstanding amount of loan.

- When the property has been acquired in the current year, then the cost may be verified with the help of the bank passbook. He should vouch all the payments made in this connection.

- He should see that the property account should be shown in the Balance Sheet at cost price including the legal and registration charges less depreciation up-to-date.

- He should also see that a separate account for building and land on which it is constructed is maintained. It is necessary because depreciation is provided for building and not for the land.

(ii) Leasehold Property

Leasehold is an accounting term for an asset being leased. The asset is typically property such as a building or space in a building.

- The property which is on lease (rent).

- The property (plot/flat/villa/mall/ factories) which is leased by the landlord for a certain period of time to the lessee (tenant /leaseholder/renter/ occupant/dweller).

- The (tenants) have been given the right to use during that specified time by the landlord.

- The ownership of the property returns to the landlord when the lease comes to an end.

Auditor’s Duty

- The auditor should verify this by inspecting the lease agreement or contract to find out value and duration. He should see that the terms and conditions of lease are properly complied with.

- In case property has been mortgaged, the auditor should obtain a certificate from the mortgagee regarding the possession of title deed.

- Where the leasehold property has been sub-let, the counter part of the tenant’s agreement should also be examined.

- The auditor should physically inspect the properties.

- The auditor should also note that proper provision has been made for depreciation of lease problem and for any possible claims arising there under.

-

Plant and Machinery

A plant is an asset with a useful life of more than one year that is used in producing revenues in a business’s operations. Plant is recorded at cost and depreciation is reported during their useful life.

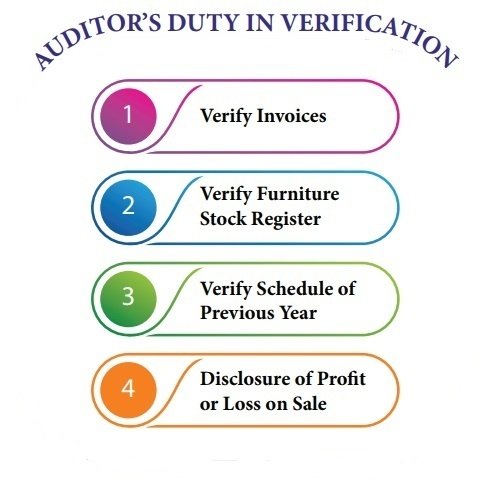

Auditor’s Duty

- When the machines are purchased in the current accounting period, the invoices and the agreement with the vendors should be verified.

- The auditor should ` examine the plant register in which particulars about the cost, records about sales, provision for depreciation, etc., are available.

- He should prepare a list of each machine from the plant register and should get the list certified by the works manager as he is not a technical person and therefore he has to depend upon the advice of the works manager regarding their valuation, etc.

- He should see that plant and machinery account is shown in the Balance Sheet at cost less depreciation after making proper adjustment for purchases and sales during the year under audit.

- In case any plant and machinery has been scrapped, destroyed or sold, he should ascertain that the profit or loss arising thereon has been correctly determined.

Valuation of Fixed Assets

- Valuation of Land: Land which does not have depreciated value, is valued at cost price.

- Valuation of Other Fixed Assets: Other fixed assets like Buildings, Plant, machinery, office equipment, furniture and fixtures should be valued at going concern value.

- Depreciation: Auditor should ensure that adequate amount of depreciation has been provided, taking into account the working life and usage of the asset.

- Disclosure in Balance Sheet: He should verify that furniture, fittings and fixtures are disclosed in Balance Sheet at cost less depreciation.

One thought on “Verification and Valuation of different Items”