Retail Theories

Retail theories encompass a wide range of concepts and models that help explain the dynamics, strategies, and challenges within the retail industry. These theories are developed to provide insights into consumer behavior, market trends, and effective retail management.

Retail theories provide valuable frameworks for understanding and navigating the complex dynamics of the retail industry. From consumer behavior and store location to marketing strategies and the impact of technology, these theories guide retailers in making informed decisions and staying competitive in an ever-evolving marketplace. The retail landscape continues to transform, and the application of these theories allows retailers to adapt, innovate, and meet the evolving needs of consumers.

This session deals with the following theories namely:

- Wheel of Retailing

- Retail Accordian Theory

- Theory of Natural Selection

- Retail life cycle

Wheel of Retailing

This theory talks about the structural changes in retailing. The theory was proposed by Malcomb McNair and according to this theory it describes how retail institutions change during their life cycle. In the first stage when new retail institutions start business they enter as low status, low price and low margin operations. As the retail firms achieve success they look in for increasing their customer base.

They begin to upgrade their stores, add merchandise and new services are introduced. Prices are increased and margins are raised to support the higher costs. New retailers enter the market place to fill the vacuum, while this continues to move ahead as a result of the success. A new format emerges when the store reaches the final stage of the life cycle. When the retail store started it started low but when markets grew their margins and price changed. The theory has been criticized because they do not advocate all the changes that happen in the retail sector and in the present scenario not all firms start low to enter the market

Retail Accordian Theory

This theory describes how general stores move to specialized stores and then again become more of a general store. Hollander borrowed the analogy ‘accordian’ from the orchestra. He suggested that players either have open accordion representing the general stores or closed accordions representing narrow range of products focusing on specialized products. This theory was also known as the general-specific-general theory. The wheel of retailing and the accordion theory are known as the cyclical theories of retail revolution

Theory of Natural selection

According to this theory retail stores evolve to meet change in the microenvironment. The retailers that successfully adapt to the technological, economic, demographic and political and legal changes are the ones who are more likely to grow and prosper. This theory is considered as a better one to wheel of retailing because it talks about the macro environmental variables as well, but the drawback of this theory is that if fails to address the issues of customer taste, expectations and desires

Retail Life cycle

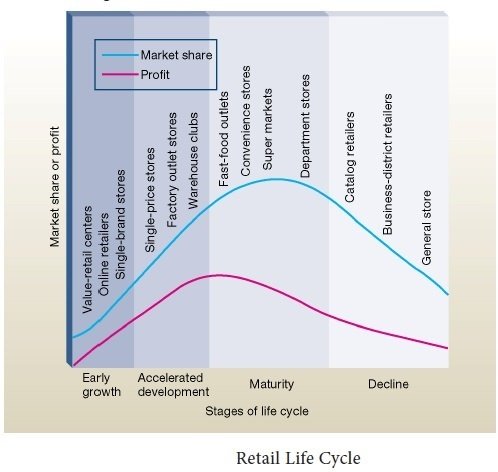

Like products, brands retail organizations pass through identifiable stages of innovation, accelerated development, maturity and decline. This is commonly known as the retail life cycle. Any organization when in the innovation stage is nascent and has few competitors. They try to create a distinctive advantage to the final customers. Since the concepts are new at this stage organizations try to grow rapidly and the management tries to experiment. Profits will be moderate and the stage may last for a couple of years. When we talk about our country e-buying or online shopping is in the innovation stage.

In the accelerated growth phase the organizations face rapid increase in sales, competitors begin to emerge and the organizations begin to use leadership and their presence as a tool in stabilizing their position. The investment level will be high as there are others who will be creating a lot of competition. This level may go up to eight years. Hypermarkets, Dollar stores are in this stage. In the maturity stage as competition intensifies newer forms of retailing begin to emerge, the growth rate starts to decline. At this stage firms should start work on strategies and reposition techniques to be in the market place. Supermarkets, cooperative stores are in this stage. In the final stage of the retail life cycle is the declining phase where firms begin to loose their competitive advantage. Profitability starts to decline further and the overheads starts to rise. Thus we see that organizations needs to adopt different strategies at each level in order to sustain in the marketplace.

Consumer Behavior Theories:

- Wheel of Retailing:

The Wheel of Retailing theory, proposed by Malcolm P. McNair in the 1950s, suggests that retail firms evolve through predictable stages. Retailers initially enter the market with low-status, low-margin operations and gradually add services and amenities as they succeed. Over time, this process may lead to higher prices and increased competition, eventually prompting the entry of new low-status retailers. The cycle continues.

-

Retail Life Cycle:

Building on the Wheel of Retailing, the Retail Life Cycle theory posits that retail formats go through distinct life stages, including introduction, growth, maturity, and decline. Each stage is associated with specific challenges and opportunities. Understanding the life cycle helps retailers adapt strategies based on their position in the market.

-

Customer Decision-Making Process:

The Consumer Decision-Making Process theory outlines the steps consumers go through when making purchasing decisions. These steps include problem recognition, information search, evaluation of alternatives, purchase decision, and post-purchase evaluation. Retailers use this theory to tailor marketing strategies to influence consumers at each stage.

Store Location Theories:

- Central Place Theory:

The Central Place Theory, developed by Walter Christaller, explores the optimal spatial arrangement of retail centers within a geographic area. It posits that consumers will travel to the nearest central place (retail center) to fulfill their shopping needs. Larger retail centers offering a broader range of goods and services are located less frequently but serve a larger population.

-

Huff’s Gravity Model:

The Huff’s Gravity Model predicts the probability of a consumer choosing a particular store based on its attractiveness (size, offerings) and distance. This model is valuable for retailers in understanding consumer behavior related to store choice and optimizing their location strategies.

Retail Marketing Theories:

- Retail Mix:

The Retail Mix theory, also known as the 6 Ps of retailing (Product, Price, Place, Promotion, Presentation, and Personnel), emphasizes the interconnected elements that retailers must consider when creating a marketing strategy. Balancing these elements is essential for a cohesive and effective retail marketing approach.

- STP Marketing:

STP stands for Segmentation, Targeting, and Positioning. In retail, this theory involves identifying market segments, selecting target segments that align with the retailer’s strengths, and positioning the store to meet the specific needs and preferences of those target customers.

-

Retail Atmospherics:

Retail Atmospherics theory explores how the physical environment of a store, including lighting, colors, scents, and layout, affects consumer perceptions and behavior. Creating a pleasant and engaging atmosphere enhances the overall shopping experience and influences purchasing decisions.

Retail Evolution Theories:

- Wheel of Retailing Evolution:

The Wheel of Retailing Evolution theory builds on the Wheel of Retailing, proposing that retailers evolve through stages of innovation, growth, maturity, and decline. New retailers often introduce innovative formats, challenging existing structures and leading to a continuous cycle of evolution in the retail industry.

- Retail Life Cycle Evolution:

Similar to the Retail Life Cycle, this theory suggests that retail formats evolve through stages of introduction, growth, maturity, and decline. The evolution may involve changes in format, strategies, and consumer offerings to adapt to market conditions and competition.

Technology and Omnichannel Retailing Theories:

- Technology Adoption Curve:

The Technology Adoption Curve, developed by Everett Rogers, categorizes consumers into innovators, early adopters, early majority, late majority, and laggards based on their readiness to adopt new technologies. Retailers use this theory to guide their adoption of technology and innovation strategies.

-

Omnichannel Retailing:

Omnichannel Retailing theory emphasizes the integration of various channels (online, offline, mobile, etc.) to provide a seamless and unified shopping experience for consumers. It recognizes that consumers may engage with retailers through multiple channels and aims to create a cohesive brand experience across all touchpoints.

Retail Strategy Theories:

- Porter’s Generic Strategies:

Developed by Michael Porter, this theory outlines three generic strategies for competitive advantage: cost leadership, differentiation, and focus. Retailers can pursue one of these strategies to position themselves in the market and gain a competitive edge.

-

Wheel of Retailing Strategy:

The Wheel of Retailing Strategy theory suggests that retailers should strategically choose their positioning within the Wheel’s evolution stages. For example, a retailer may opt for a low-cost strategy as a low-status entrant or differentiate through innovation as a higher-status player.

Sustainability in Retailing:

- Green Retailing:

With a growing emphasis on sustainability, Green Retailing theory focuses on environmentally friendly retail practices. This includes sustainable sourcing, energy-efficient operations, waste reduction, and efforts to appeal to environmentally conscious consumers.

-

Circular Economy in Retailing:

The Circular Economy theory promotes a regenerative approach where products, materials, and resources are kept in use for as long as possible. Retailers adopting circular economy principles aim to reduce waste, recycle materials, and create more sustainable product life cycles.