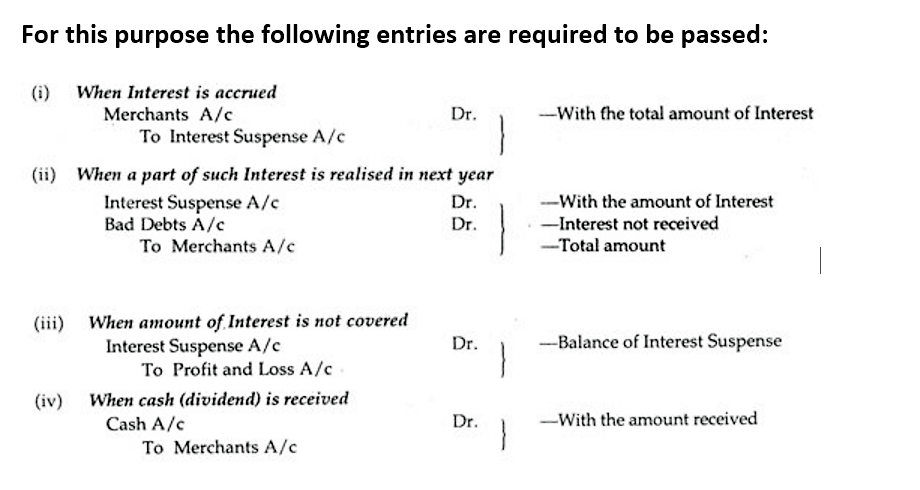

(a) Interest Suspense Method:

From the standpoint of conservatism, interest on doubtful loans should be transferred to Interest Suspense Account and, at the same time, when the interest is realized (either in part or whole) the same is credited.

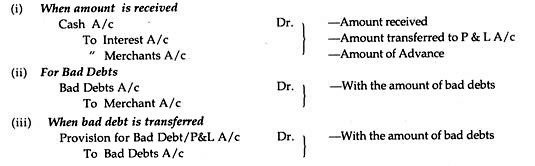

(b) Cash Basis Method:

No separate entry is required for Interest on doubtful loans. Since interest on such loans comes under Non-performing Assets, as such, such interest should not be recognized from conservatism point of view cash basis method is the best one.

The entries are:

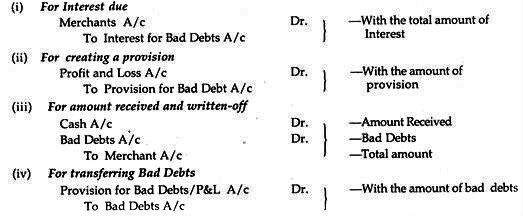

(c) Accrual Basis Method:

Under this method, the whole amount of interest is to be credited and, at the same time, a provision should also be made for such interest to Bad and Doubtful Debts Account.

The entries under this method are:

One thought on “Interest on doubtful debts”