Financial sector is the mainstay of any economy and it contributes immensely in the mobilization and distribution of resources. Financial sector reforms have long been viewed as significant part of the program for policy reform in developing nations. Earlier, it was thought that they were expected to increase the efficiency of resource mobilization and allocation in the real economy to generate higher rates of growth. Recently, they are also seen to be critical for macroeconomic stability. It was due to the repercussion of the East Asian crisis, since weaknesses in the financial sector are broadly regarded as one of the major causes of collapse in that region.

The elements of the financial sector are Banks, Financial Institutions, Instruments and markets which mobilize the resources from the surplus sector and channelize the same to the different needy sectors in the economy. The process of accumulative capital growth through institutionalization of savings and investment fosters economic growth. Reform of the financial sector was recognized, from the very beginning, as an integral part of the economic reforms initiated in 1991. The economic reform process occurred amidst two serious crisis involving the financial sector the balance of payments crisis that endangered the international credibility of the country and pushed it to the edge of default; and the grave threat of insolvency confronting the banking system which had for years concealed its problems with the help of faulty accounting strategies. Furthermore, some deep rooted problems of the Indian economy in the early nineties were also strongly related to the financial sector such as large scale pre-emption of resources from the banking system by the government to finance its fiscal deficit. Excessive structural and micro regulation that inhibited financial innovation and increased transaction costs. Relatively inadequate level of prudential regulation in the financial sector. Poorly developed debt and money markets. And outdated (often primitive) technological and institutional structures that made the capital markets and the rest of the financial system highly inefficient (Mathieu, 1998).

Major aims of the financial sector reforms are to allocate the resources proficiently, increasing the return on investment and hastened growth of the real sectors in the economy. The processes introduced by the Government of India under the reform process are intended to upturn the operational efficiency of each of the constituent of the financial sector.

The major delineations of the financial sector reforms in India were found as under:

- Removal of the erstwhile existing financial repression.

- Creation of an efficient, productive and profitable financial sector.

- Enabling the process of price discovery by the market determination of interest rates that improves allocate efficiency of resources.

- Providing operational and functional autonomy to institutions.

- Preparing the financial system for increasing international competition.

- Opening the external sector in a calibrated manner.

- Promoting financial stability in the wake of domestic and external shocks.

At global level, financial sector reforms have been driven by two apparently contrary forces. The first is a thrust towards liberalization, which seeks to decrease, if not eliminate a number of direct controls over banks and other financial market participants. The second is a thrust in favour of strict regulation of the financial sector. This dual approach is also apparent in the reforms tried in India.

Financial and banking sector reforms are in following areas:

Financial markets

- Regulators

- The banking system

- Non-banking finance companies

- The capital market

- Mutual funds

- Overall approach to reforms

- Deregulation of banking system

- Capital market developments

- Consolidation imperative

Regulators

The Finance Ministry constantly formulated major strategies in the field of financial sector of the country. The Government acknowledged the important role of regulators. The Reserve Bank of India (RBI) has become more independent. Securities and Exchange Board of India (SEBI) and the Insurance Regulatory and Development Authority (IRDA) became important institutions. Some opinions are also there that there should be a super-regulator for the financial services sector instead of multiplicity of regulators.

Indian Banking Sector and Financial Reforms

The main intent of banking sector reforms was to uphold a diversified, efficient and competitive financial system with the aim of improving the allocative efficiency of resources through operational flexibility, improved financial viability and institutional solidification.

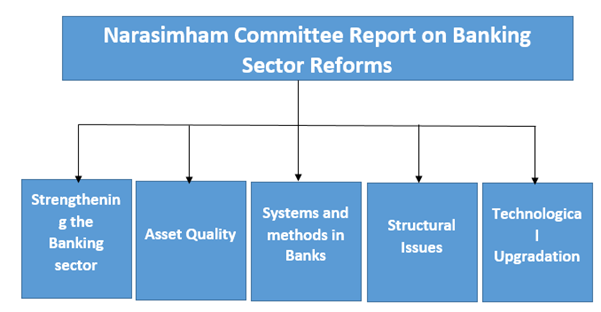

As early as August 1991, the government selected a high level Committee on the Financial System (the Narasimham Committee) to look into all facets of the financial system and make comprehensive recommendations for improvements. The Committee submitted its report in November 1991, making several recommendations for reforms in the banking sector and also in the capital market. Soon thereafter, the government announced broad acceptance of the approach of the Narasimham Committee and a process of gradualist reform in the banking sector and in the capital market was set in motion, a process that has now been under way for more than six year.

In India, around 80% of businesses are regulated by public sector banks. PSBs are still governing the commercial banking system. The RBI has given licenses to new private sector banks as part of the liberalization process. The RBI has also been granting licenses to industrial houses. Many banks are effectively running in the retail and consumer segments but are yet to deliver services to industrial finance, retail trade, small business and agricultural finance. Major change observed by individuals is many transformation in policies of the banking sector. The reforms have focussed on eliminating financial repression through reductions in statutory pre-emptions, while stepping up prudential regulations at the same time. Additionally, interest rates on both deposits and lending of banks have been gradually deregulated.

The major reforms relating to the banking system were:-

- Capital base of the banks were strengthened by recapitalization, public equity issues and subordinated debt.

- Prudential norms were introduced and progressively tightened for income recognition, classification of assets, provisioning of bad debts, marking to market of investments.

- Pre-emption of bank resources by the government was reduced sharply.

- New private sector banks were licensed and branch licensing restrictions were relaxed.

Similarly, several operational reforms were introduced in the area of credit policy:

- Detailed regulations relating to Maximum Permissible Bank Finance were abolished.

- Consortium regulations were relaxed substantially.

- Credit delivery was shifted away from cash credit to loan method.

Many reports signified that the initial steps have been taken in the form of allowing new banks to set up shop. Private Corporates, public sector entities and Non-Banking Finance Companies with a strong track record can now apply to set up new banks and the Reserve bank of India will consider these applications in the coming months. The addition of new banks will mean more competition for this sector in the country and it will lead to a development in services for the end customer. It is anticipated to increase financial enclosure as more and more people across the country will be able to access banking facilities. In reforms for the existing banks the public sector banks have been allowed to increase or decrease the authorized capital without the presence of an overall ceiling. This will provide greater flexibility to the banks to conduct their fund raising activities as per the requirements. The strict restriction of voting rights in banks will also be relaxed and this will aid the banking sector to develop, as large investors will be able to get a bigger voice in the coming days in the banks and the manner in which they operate.

When evaluating banking sector reform, it can be identified that banks have experienced strong balance sheet growth in the post-reform period in an environment of operational flexibility. Enhancement in the financial health of banks, reflected in noteworthy improvement in capital adequacy and improved asset quality, is distinctly observable. It is striking that this progress has been realised despite the espousal of international best practices in prudential norms. Competitiveness and productivity gains have also been enabled by proactive technological deepening and flexible human resource management. These significant gains have been achieved even while renewing goals of social banking viz. maintaining the wide reach of the banking system and directing credit towards important but underprivileged sectors of civilization.

Forex market reform

Forex market reform took place in 1993 and the successive adoption of current account convertibility were the acmes of the forex reforms introduced in the Indian market. Under these reforms, authorised dealers of foreign exchange as well as banks have been given greater sovereignty to perform in activities and numerous operations. Additionally, the entry of new companies have been allowed in the market. The capital account has become effectively adaptable for non-residents but still has some reservations for residents.

Impact on the Reform Measures

The broader objectives of the financial sector reform process are to articulate the policy to enhance the financial condition and to reinforce the institutions. As part of the reforms process, many private banks were granted licence to operate in India. This has resulted into a competitive environment in the banking industry which in turn has assisted in using the resources more competently. Conventionally, the industrial units were sanctioned term loan by the development banks and working capital by the commercial banks. The reform process has transformed the pattern of financing and now both the institutions are willing to extend long term loan as well as working capital loan. But there is some difference in the mode of operation. This has empowered the industrial units to avail credit facilities from a single institution. Despite the fact that the banks provide both the term loan and the working capital loans, the industrial units prefer the development banks for the following reasons.

- It provides equal support to the new as well as existing industries.

- The period of repayment of loan is comparatively longer.

Besides providing financial backing, it acts as the implementing agency for the different government sponsored schemes. Hence the industrial units can avail of both the financial assistance as well as the incentives offered under various development schemes through a Single Window System. As lending is the main activity of these institutions, it acquires specialization in this field and can share its expertise with the industrial units.

Capital Market Reform

Capital market is defined as a financial market that works as a channel for demand and supply of debt and equity capital. It channels the money provided by savers and depository institutions (banks, credit unions, insurance companies, etc.) to borrowers and investees through a variety of financial instruments (bonds, notes, shares) called securities. A capital market is not a compact unit, but a highly decentralized system made up of three major parts that include stock market, bond market, and money market. It also works as an exchange for trading existing claims on capital in the form of shares. The Capital Market deals in the long-term capital Securities such as Equity or Debt offered by the private business companies and also governmental undertakings of India.

In the agenda of financial sector reforms, Improvement of the capital market is important area and action has been taken parallel with reforms in banking. India has experienced functioning in capital markets the Bombay Stock Exchange (BSE) for over a hundred years but until the 1980s, the volume of activity in the capital market was relatively limited. Capital market activity extended rapidly in the 1980s and the market capitalization of companies registered in the BSE rose from 5 per cent of GDP in 1980 to 13 per cent in 1990. It is observed that the Indian capital market has perceived major reforms in the decade of 1990s and thereafter. It is on the edge of the growth. Thus, the Government of India and SEBI took numerous measures in order to improve the working of the Indian stock exchanges and to make it more progressive and energetic. The Securities and Exchange Board of India (SEBI) was well-known in 1988. It got a legal status in 1992. SEBI was principally set up to control the activities of the commercial banks, to control the operations of mutual funds, to work as a promoter of the stock exchange activities and to act as a regulatory authority of new issue activities of companies. The SEBI was established with the vital objective, “to protect the interest of investors in securities market and for matters connected therewith or incidental thereto.” The main functions of SEBI are as follows:

- To control the business of the stock market and other securities market.

- To promote and regulate the self-regulatory organizations.

- To forbid fraudulent and unfair trade practices in securities market.

- To promote awareness among investors and training of intermediaries about safety of market.

- To prohibit insider trading in securities market.

- To regulate huge acquisition of shares and takeover of companies.

However the stock market remained primeval and poorly controlled. Companies who want to access the capital market needed prior permission of the government which also had to approve the price at which new equity could be raised. While new issues were strictly controlled, there was insufficient regulation of stock market activity and also of various market participants including stock exchanges, brokers, mutual funds, etc. The domestic-capital market was also closed to portfolio investment from abroad except through a few closed ended mutual funds floated abroad by the Unit Trust of India (UTI) which were committed to Indian investment.

The practice of reform of the capital market was started in 1992 along the lines recommended by the Narasimham Committee. It was intended to remove direct government control and replacing it by a regulatory framework based on transparency and disclosure supervised by an independent regulator. The first step was taken in 1992 when the Securities and Exchange Board of India (SEBI), which was initially established as a non-statutory body in 1988, was raised to a complete capital market regulator with statutory powers in 1992. The requirement of prior government permission for accessing capital markets and for prior approval of issue pricing was stopped and companies were permissible to access markets and price issues freely, subject only to disclosure norms laid down by SEBI.

The Regulatory Framework

As the time passed, SEBI has implemented a modern regulatory framework with rules and regulations to control the behaviour of major market participants such as stock exchanges, brokers, merchant bankers, and mutual funds. It has also sought to control activities such as takeovers and insider trading which have implications for investor protection. The governing structure of stock exchanges has been changed to make the boards, of the exchanges more broad based and less dominated by brokers. The new regulatory framework intended to support investor protection by ensuring disclosure and transparency rather than through direct control. SEBI acts as a supervisor of the system undertaking supervision of the activities of various participants including stock exchanges and mutual funds and violations of the rules are punishable by SEBI.

The regulatory framework is new and there is a need to be advanced with experience gained and also as gaps and insufficiencies are identified. SEBI needs to be further strengthened in some areas and its disciplinary powers.

Opening the Capital Market to Foreign Investors

Significant policy initiative in 1993 was the opening of the capital market to foreign institutional investors (FIIs) and allowing Indian companies to raise capital abroad by issue of equity in the form of global depository receipts (GDRs).

Modernization of Trading and Settlement Systems

Major developments occurred in trading methods which were highly antiquated earlier. The National Stock Exchange (NSE) was established in 1994 as an automated electronic exchange. It empowered brokers in 220 cities all over the country to link up with the NSE computers via VSATs and trade in a unified exchange with automatic matching of buy and sell orders with price time priority, thus ensuring maximum transparency for investors. The initiation of electronic trading by the NSE generated competitive pressure which forced the BSE to also introduce electronic trading in 1995.

The settlement system was old-fashioned which involved physical delivery of share certificates to the buyer who then had to deliver them to a company registrar to record change of ownership after which the certificates had to be returned to the buyer. This process was consuming and also had significant risks for investors. The first step towards paperless trading was put in place by enacting legislation which allowed dematerialization of share certificates with settlement by electronic transfer of ownership from one account to another within a depository. The National Securities Depository Ltd (NSDL) opened for business in 1996.

Futures Trading

Currently, an important gap in India’s capital market is future markets. Good market in index futures would help in risk management and provide greater liquidity to the market. A decision to present futures trading has been taken and the legislative changes needed to implement this decision have been submitted to parliament.

Several Problems in the Capital Market

Though, there are numerous reforms made in the regulatory framework and trading and settlement systems, the functioning of the capital market in the post-reform period has been heavily criticized. Investors, particularly small investors who entered the market in the early stages of liberalization, did not get good value of their investments. It was perceived that many dishonest companies took advantage of the exclusion of government control over issue prices to raise capital at inflated prices, at the expense of inexperienced investors. Merchant bankers and underwriters involved in these issues.

Issuers of capital must also understand that the capital market should not be viewed, as a passive source of equity capital which can be tapped by companies at will to raise equity on favourable terms. Cross-country studies have revealed that stock markets in developing countries have been an important source for financing of new investments through IPOs than in developed countries where financing of new investment has relied mainly on internal generation of surpluses. New companies raising funds have typically relied on venture capital or private placement rather than public issues.

Mutual Funds

Presently, the mutual funds industry is controlled under the SEBI (Mutual Funds) Regulations, 1996 and amendments thereto. With the issuance of SEBI rules, the industry had a framework for the setting up of many more companies, both Indian and foreign firms. The Unit Trust of India is biggest mutual fund controlling a quantity of nearly Rs.70,000 crores, but its share is going down. With the growth in the securities markets and tax advantages granted for investment in mutual fund units, mutual funds became widespread. The foreign owned AMCs are the ones which are now setting the pace for the industry. They are introducing new products, setting new standards of customer service, improving disclosure standards and experimenting with new types of distribution.

Reform of the Insurance Sector

The Insurance sector in India directed by Insurance Act, 1938, the Life Insurance Corporation Act, 1956 and General Insurance Business (Nationalization) Act, 1972, Insurance Regulatory and Development Authority (IRDA) Act, 1999 and other related Acts. The basis of liberalizing the banking system and encouraging competition among the three major participants’ viz. public sector banks, Indian private sector banks, and foreign banks, applies equally to insurance. There is a strong case for ending the public sector monopoly in insurance and opening it up to private sector participants subject to suitable prudential regulation.

Cross-country data advocates that contractual savings institutions are highly significant determinant of the aggregate rate of savings and insurance and pension schemes are the most important form of contractual savings in this reference. A competitive insurance industry providing diversified insurance products to fulfil differing customer needs, can help increase savings in this situation and allocate them efficiently. The insurance and pensions industry has long-term liabilities which it seeks to match by investing in long-term secure assets. A healthy insurance is an important source of long-term capital in domestic currency which is especially for infrastructure financing. Improvements in insurance will strengthen the capital market at the long-term end by adding new companies in this section of the market, giving it greater depth or liquidity. Reforms in insurance are likely to create a flow of finance for the corporate sector if people can simultaneously make progress in reducing financial deficit.

The Malhotra Committee had suggested opening up the insurance sector to new private companies as early as 1994. It took five years to build an agreement on this issue and legislation to open up insurance, allowing foreign equity up to 26 per cent was finally submitted to Parliament in 1999.

Overall Approach to Reforms

It is assessed that since last many years, there have seen major improvements in the working of various financial market contributors. The government and the regulatory authorities have followed a step-by-step approach. The entry of foreign companies has helped in the start of international practices and systems. Technology developments have enhanced customer service. Some gaps however remain such as lack of an inter-bank interest rate benchmark, an active corporate debt market and a developed derivatives market. In general, the cumulative effect of the developments since 1991 has been quite encouraging. An indication of the strength of the reformed Indian financial system can be seen from the way India was not affected by the Southeast Asian crisis.

To summarize, the financial sector is main element of the Indian economic system. Financial experts suggested that there is a need for effective reforms to ensure that this remains competitive and attractive for investors from across the world. The economic reforms have preferred the need for changing the policy objective to promotion of industries and the formation of more integrated infrastructural facilities. Financial sector reforms are centre point of the economic liberalization that was introduced in India in mid-1991. It was witnessed that national financial liberalisation has brought about the deregulation of interest rates, dismantling of directed credit, improving the banking system, enhancing the functioning of the capital market that include the government securities market. Regulators and economic experts put more emphasis on banking reforms to enhance economy and enable people to access numerous facilities. Fundamental objective of financial sector reforms in the 1990s was to create an effectual, competitive and steady that could contribute in greater measure to inspire progression.

3 thoughts on “Financial System Reforms in India”