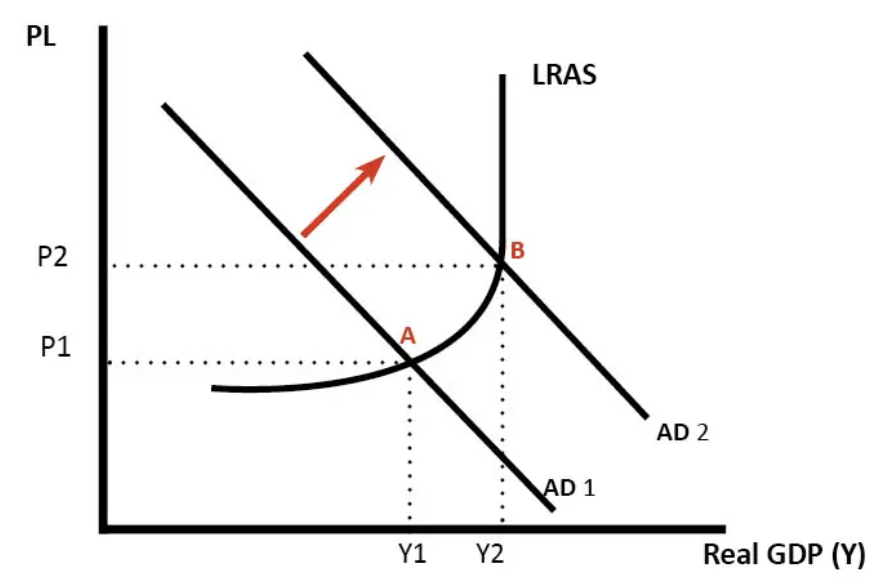

Demand-pull inflation is asserted to arise when aggregate demand in an economy outpaces aggregate supply. It involves inflation rising as real gross domestic product rises and unemployment falls, as the economy moves along the Phillips curve. This is commonly described as “too much money chasing too few goods. “More accurately, it should be described as involving “too much money spent chasing too few goods,” since only money that is spent on goods and services can cause inflation. This would not be expected to happen, unless the economy is already at a full employment level. It is the opposite of cost-push inflation.

Causes of demand-pull inflation

- There is a quick increase in consumption and investment along with extremely confident firms.

- There is a sudden increase in exports due to huge under-valuation of the currency.

- There is a lot of government spending.

- The expectation that inflation will rise often leads to a rise in inflation. Workers and firms will increase their prices to ‘catch up’ to inflation.

- There is excessive monetary growth, when there is too much money in the system chasing too few goods. The ‘price’ of a good will thus increase.

- There is a rise in population.

- A depreciation of the exchange rate which makes exports more competitive in overseas markets leading to an injection of fresh demand into the circular flow and a rise in national and demand for factor resources – there may also be a positive multiplier effect on the level of demand and output arising from the initial boost to export sales.

- Higher demand from a government (fiscal) stimulus e.g. via a reduction in direct or indirect taxation or higher government spending and borrowing. If direct taxes are reduced, consumers will have more disposable income causing demand to rise. Higher government spending and increased borrowing feeds through directly into extra demand in the circular flow.

- Monetary stimulus to the economy: A fall in interest rates may stimulate too much demand, for example in raising demand for loans or in causing rise in house price inflation.

- Faster economic growth in other countries, Providing a boost to UK exports overseas.

- Improved business confidence which prompts firms to raise prices and achieve better profit margins

Demand-pull inflation means:

- Excess demand and ‘too much money chasing too few goods.’

- The economy is at (or ver close to) full employment/full capacity.

- The economy will be growing at a rate faster than the long-run trend rate.

- A falling unemployment rate.

How demand-pull inflation occurs

If aggregate demand is rising at 4%, but productive capacity is only rising at 2.5%; firms will see demand outstripping supply. Therefore, they respond by increasing prices.

Also, as firms produce more, they employ more workers, creating a rise in employment and fall in unemployment. This increased demand for workers puts upward pressure on wages, leading to wage-push inflation. Higher wages increase the disposable income of workers leading to a rise in consumer spending.

2 thoughts on “Demand Pull inflation”