When the time comes to purchase or renew insurance, people have a variety of resources at their fingertips to help them from discovery to purchase. Today, online channels provide an alternative to traditional conversations with insurance agents in person and on the phone.

This blended path to purchase for property and car insurance is more complex than for consumer goods, such as make-up, or even for more considered purchases such as holidays. It is also often tied to other major purchases, such as a home or car, and can happen within a comparatively tight timeframe. For this reason, it’s crucial for insurance brands to be top of mind when consumers need to make a purchase.

To help marketers understand how their customers and potential customers navigate the path to purchase for insurance, we set out to learn more about their mindsets and goals at each stage: discovery, evaluation, comparison and purchase. Focusing on the role online and mobile platforms play throughout the buying journey, Facebook IQ commissioned Accenture to survey 996 insurance consumers in India who bought car or property insurance products in the three months prior to July 2018.

How do people discover insurance brands and products?

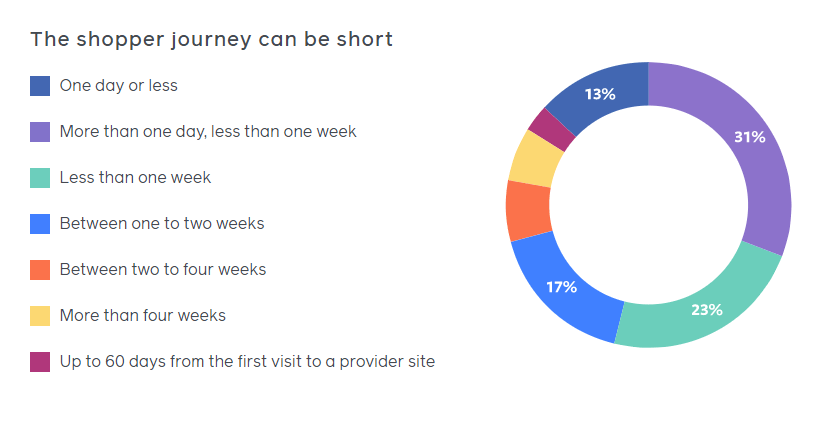

People buy insurance products often in tandem with the purchase or rental of a property or car, and more out of necessity. As such, the discovery stage can also be short.

The survey revealed that 77% of insurance shoppers say they’re loyal to a particular insurance brand, and 62% say they only initially consider one to three brands. In fact, first-time insurance purchasers are 1.5 times more likely1 to consider five brands or more compared to repeat purchasers who consider a more limited set of brands. This suggests an opportunity to connect with those customers who are not yet loyal to a brand, particularly for insurance brands and products that are new to the market.

Online is the top discovery channel for first-time buyers, with 61% of car insurance consumers and 76% of property insurance consumers finding new brands and products on their computer, tablet or smartphone.

In addition, insurance consumers rely heavily on the wisdom of the crowd, with 47% of them discovering and 46% evaluating insurance brands through conversations with friends and family.

These conversations with friends and family often happen online, with social platforms playing a key role in their discovery of new insurance products and brands. The survey revealed that 77% of people discover property insurance brands and products on the Facebook family of apps2 and that 69% of them say they are more likely to be interested in an insurance brand or product they see advertised on Facebook and other social platforms.

How do customers evaluate insurance brands and products?

Although insurance agents still play an important role to people looking to purchase insurance, 3 online channels are particularly important at the evaluation stage. The survey revealed that 56% of property insurance purchasers say their mobile device plays a role in the evaluation of products and brands. For car insurance in particular, first-time buyers are 1.4 times more likely than repeat buyers to consider mobile to be an important evaluation device.

What’s important to people when choosing insurance?

Consumers consider various factors to be important when researching and evaluating insurance brands and products:

Digital capabilities:

This reflects larger industry trends and is a sign that all insurance providers need to adapt to changing expectations. An insurer’s digital offering is particularly influential for first-time purchasers. And this digital offering doesn’t end with purchase – brands also need to consider the post-purchase customer experience. Customers who discover, evaluate and purchase their insurance online often don’t want to print, complete and post out a 20-page claims form.

Personalisation and insurance on demand:

The ability to build an insurance package tailored to their individual needs rather than being tied into a year-long, out-of-the-box policy is particularly appealing to younger audiences.

Price, quality of service and company reputation:

Our study showed that these factors remain important for everyone. Interestingly, while 85% of people consider price an important factor when deciding on an insurer or insurance package, only 41% of agents provide an online quote service.

How do people buy insurance?

Amongst those surveyed, the majority of insurance purchases happen online: 44% of car insurance consumers and 49% of property insurance consumers buy on their computer, tablet or smartphone. With online channels playing such a prominent role in the path to purchase, insurance companies need to adapt and ensure that their purchase process is easy and seamless.

What it means for marketers

Design mobile-friendly, seamless online experiences.

Over half of consumers surveyed say that an easy application process is influential when deciding which insurance to buy. Simplify the application process and embrace digital across all areas of your customer journey to minimise wait time and reduce other consumer pain points with a seamless experience across all your channels.

Experiment with instant communication.

Leverage new technology to ensure that agents are easily accessible to provide personalised advice and recommendations for every stage of the journey.

Anticipate the distinct needs of your audience.

To ensure that your brand is considered by millennial buyers, leverage platforms where people are already looking to discover insurance products. Make your brand stand out by highlighting personalised packages and unique product differentiation to move people away from decisions based solely on price, and provide more engaging, relevant experiences with personalised messaging.

One thought on “Insurance Customers and their Buying Patterns”