Short Run Equilibrium

Equilibrium of a firm under monopolistic competition is often couched in terms of short period and long period. In the short run, Chamberlin’s model of monopolistic competition comes closer to monopoly.

That is to say, there is virtually no difference between monopolistic competition and monopoly in the short run. Thus, Chamberlin’s firm may earn supernormal profit, normal profit, or incur loss in the short run—since entry and exit are not allowed during this time period.

In Fig. 1, the short run marginal cost curve, SMC, is equal to MR at point E. Thus E is the equilibrium point. Corresponding to this equilibrium point, the firm produces OQ output and sells it at a price OP. Thus, the firm earns pure profit to the extent of PARB since total revenue (OPAQ) exceeds total cost of production (OBRQ).

A firm, in the short run, may earn only normal profit if MC = MR < AR = AC occurs. A loss may result in the short run if MC = MR < AR < AC happens

Long Run Equilibrium

In the long run, monopolistic competition comes closer to perfect competition because the freedom of entry and exit allows firms to enjoy only normal profit.

Whenever some firms earn pure profit in the long run some other firms may be attracted to join this product group, thereby shifting the demand curve or AR curve downward and to the left. Thus, entry of new firms would cause decline in market share by reducing the demand for its product.

Consequently, excess profit will be reduced to zero. Further, if the existing firm experiences losses then the exit of firms will bring about an opposite effect and the process will continue until normal profit is earned driving excess profit to zero. Seeing losses for a long time, losing firms may be induced to leave the product group thereby eliminating losses. Thus all firms in the long run earn only normal profit.

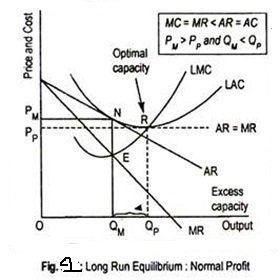

Long run equilibrium is achieved at point E where LMC equals MR (Fig. 2). The equilibrium output thus determined is OQM. At this output, AR equals AC. The firm gets normal profit by selling OQM output at the price OPM. Note that a monopolistically competitive firm always operates somewhere to the left of the minimum point of its AC curve.

In other words, as the demand curve is not perfectly elastic, or, as the demand curve is negative sloping, the AR curve becomes tangent to the left of the lowest point of the AC curve (say, point N). Each firm thus produces at a cost higher than the minimum and gets only normal profit.

Under perfect competition, long run equilibrium is achieved at that point where MC = MR = AR = AC. Because of the perfectly elastic AR curve, a tangency occurs between AR and AC at the latter’s lowest point. In Fig. 2 the dotted AR = MR curve is the demand curve faced by a competitive firm.

Equilibrium is attained at point R where LMC = MR = AR = lowest point of LAC. The competitive output thus determined is OQP which will be sold at the price OPP. So, we can conclude that monopolistically competitive output (OPM) is less than the perfectly competitive output (OQP), and monopolistically competitive price (OPM) is larger than competitive price (OPP).

Thus, the difference in output — QMQP— measures excess capacity or unused capacity faced by monopolistically competitive firms. Production at a higher cost implies wastage of resources or underutilization of resources.

Since production takes place at the lowest point of AC curve under perfect competition, there does not occur any wastage of resources. Hence a perfectly competitive market is ‘efficient’ in the sense that resources are allocated efficiently. Society gets larger output and consumers get output at a low price. Thus, as perfect competition maximizes social welfare, it is an ideal market.

But as the monopolistically competitive firm operates to the left of the minimum point of its AC curve, this market is considered as an ‘inefficient’ one. As a result, social welfare is not maximized under monopolistic competition since society gets lower output compared to perfectly competitive output and buyers buy the differentiated products at a high price.

Dominick Salvatore argues:

“Excess capacity permits more firms to exit (i.e., it leads to overcrowding) in monopolistically competitive markets as compared with perfect competition. Consumers, however, seem to prefer that firms selling some services operate with same unused capacity (i.e., they are willing to pay a slightly higher price…) so as to avoid waiting in long lines.”

However, Chamberlin’s notion of excess capacity does not fall with the arguments advanced here.