Bill discounting is the fee or the ‘discount’ that a bank charges a seller of the bill in exchange of releasing the funds to him before the due date of the bill. Essentially, bill discounting is the exchange of the bill for money, either from a bank or any third party.

Present Value

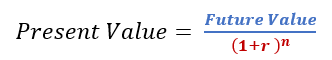

To fully understand the concept of bill discounting, we need to learn about a few more important terms. One of these terms is present value (PV). Present Value is the current value of a sum of money in the future. So by discounting this future sum of money by a fixed discount rate, we arrive at its present value.

Hence, the higher the discount rate, lower the present value of the sum of money. It is an inverse proportion. Present Value indicates that an ‘x’ amount of money is worth more in the present than the same amount is in the future.

- r = rate of return

- n= number of years/periods

True Discount

This is also an important concept to learn in the discounting of bills. Now the total sum of money due at the end is known as the “Amount (A)”. The present worth or value of this sum is the PV.

The difference between the two is what we call the “True Discount (TD)”. Basically, the interest accrued on the Present Value of the sum is the True Discount. Let us learn its formula.

TD = Amount/Future Value – Present Value

Now while True Discount is the interest amount on the Present Value, there is another term known as the Bankers Discount. This is actually the Simple Interest on the face value of the sum from the date of the discounting to the due date of the bill.

Hence, the difference between the true discount and the bankers discount (fee for discounting the bill early) is known as the Bankers Gain.

Advantages of Bill Discounting

- Access Funds Quickly

No entrepreneur can avail conventional working capital loans without meeting the eligibility criteria set by the lending institutions. Many lending institutions even require additional time to process and disburse small business loans. Hence, many business owners opt for bill discounting to avail funds without lengthy approval process. A number of NBFCs even enables borrowers to avail cash in 72 hours by discounting their unpaid invoices.

- Improve Cash Flow Position

Often small businesses have to sell goods in credit to expand customer base. When they sell goods on credit, it becomes difficult for entrepreneurs to maintain positive cash flow. The invoice discounting services provided by lending institutions help entrepreneurs to improve cash flow quickly. They can even shorten the working capital cycles by converting unpaid invoices into cash.

- No Need to Incur Debt

As noted earlier, bill or invoice discounting enables business owners to fund working capital needs without increasing liabilities. The business owner can opt for this option to avail cash quickly by releasing the funds locked in unpaid invoices or bills. He can even meet working capital needs simply by converting current assets into liquid assets.

- Help Businesses to Sell Goods on Credit

Many enterprises explore ways to credit sales to maintain a positive cash flow position. But small businesses cannot acquire new customers and retain existing customers in the long run without combining cash and credit sales. The bill discounting services make it easier for enterprises to sell goods in credit by liquidating current assets and boosting cash flow.

Bill Discounting Disadvantages

- Reduces Profit Margin

The lending institutions discount bills or invoices by charging a fee. The fee normally includes interest charges, administrative expenses and maintenance expenses. The percentage of fee or discount also differs from one lender to another. Hence, the business owners have to sacrifice a percentage of the bill value. The fees charges by the lender will even impact the business’s profitability.

- All Bills Cannot Be Discounted

An entrepreneur cannot avail funds by discounting all his unpaid bills or invoices. Many lending institutions discount only commercial bill. Also, they evaluate the bills or invoices based on a number of parameters before providing funds. Hence, entrepreneur cannot rely on bill discounting as a consistent or long-term working capital funding solution.

- Not Available to New Businesses

Both banks and NBFCs provide bill discounting services only to existing customers or established enterprises. Some lending institutions even provide discount bills only if the business is generating profit. Hence, new business owners may not fund working capital needs through bill discounting service. Also, the fees charged by the lending institutions will impact their profitability in the short run.

- Reduce Available Collateral

Most banks do not provide collateral free business loans to small business owners. They require the borrowers to use their personal and business assets as collateral to avail credit. Each time a business owner discounts an invoice or bill, his working capital declines accordingly. Hence, the business owner may find it challenging to avail other working capital loans.

On the whole, bill or invoice discounting help business owners to fund working capital needs without increasing liabilities. They can avail the invoice discounting services provided by various lending institutions to avail funds before the due date of the bill or invoice. However, the percentage of discount changed by individual lenders differs. Likewise, the lenders require the business owners to meet a set of eligibility criteria to avail bill discounting services.

2 thoughts on “Bills Discounting”