Under this method, goodwill is calculated by taking average super profit as the value of an annuity over a certain number of years. The present value of this annuity is computed by discounting at the given rate of interest (normal rate of return). This discounted present value of the annuity is the value of goodwill. The value of annuity for Rupee 1 can be known by reference to the annuity tables.

Under this method, goodwill is calculated by finding the present worth of an annuity paying the super profit per year, over the estimated period discounted at the given rate of interest.

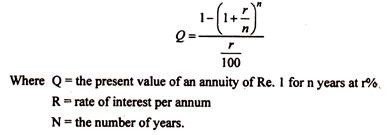

The present worth of an annuity of Re. 1 for n years at r% is obtained by the formula:

Usually reference to the Annuity Table will give the present value of annuity for the given number of years and at the given rate of interest.

Goodwill = super-profit * annuity

For example, if the super-profit is Ts. 15,000 and the annuity of re. 1 at 10% for 3 years is 2.48,685, then the goodwill is = Rs. 15,000 * 2.48,685 = Rs. 37,302.75.

This method takes into consideration the interest loss involved in paying a lump sum as goodwill in anticipation of future of profit.

2 thoughts on “Annuity Method of Valuation of Goodwill”