Statement in lieu of prospectus

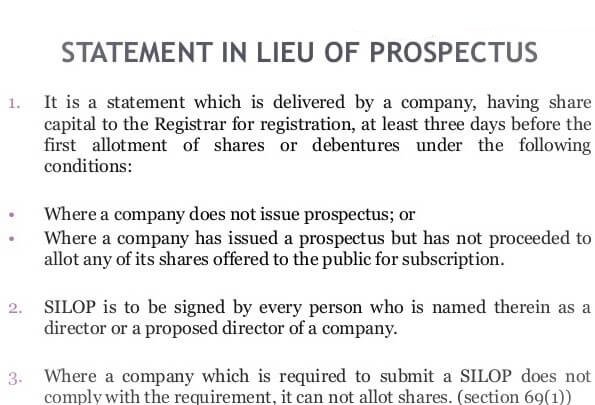

The Statement in Lieu of Prospectus is a document filed with the Registrar of the Companies ( ROC ) when the company has not issued prospectus to the public for inviting them to subscribe for shares. The statement must contain the signatures of all the directors or their agents authorized in writing. It is similar to a prospectus but contains brief information. The Statement in Lieu of Prospectus needs to be filed with the registrar if the company does not issues prospectus or the company issued prospectus but because minimum subscription has not been received the company has not proceeded for the allotment of shares.

If the promoters of a public company hope to get the subscription of capital from their own limited circle there is prospectus to the public. The promoters shall have to file ‘a statement in lieu of prospectus.

According to section 53 of the company’s ordinance. If a public company is not issuing a prospectus on its formation. It then must file a statement in lieu of Prospectus with the Registrar of the companies.

A statement in lieu of prospectus is defined as ‘a public document prepared in the second schedule of companies ordinance by every such public company which does not issue a prospectus on its formation by filing with the registrar before allotment or shares of debentures, and signed by every person who is named therein’.

A statement in lieu of prospectus gives practically the same information as a prospectus and is signed by all the directors or proposed directors. In case the company has not filed a statement in lieu of prospectus with the registrar, it is then not allowed to allot any of its shares or debentures.

Book Building

Book building is a systematic process of generating, capturing, and recording investor demand for shares. Usually, the issuer appoints a major investment bank to act as a major securities underwriter or bookrunner.

Book building is an alternative method of making a public issue in which applications are accepted from large buyers such as financial institutions, corporations or high net-worth individuals, almost on firm allotment basis, instead of asking them to apply in public offer. Book building is a relatively new option for issues of securities, the first guidelines of which were issued on October 12, 1995 and have been revised from time to time since. Book building is a method of issuing shares based on a floor price which is indicated before the opening of the bidding process.

The “book” is the off-market collation of investor demand by the bookrunner and is confidential to the bookrunner, issuer, and underwriter. Where shares are acquired, or transferred via a bookbuild, the transfer occurs off-market, and the transfer is not guaranteed by an exchange’s clearing house. Where an underwriter has been appointed, the underwriter bears the risk of non-payment by an acquirer or non-delivery by the seller.

Book building is a common practice in developed countries and has made inroads into emerging markets as well. Bids may be submitted online, but the book is maintained off-market by the bookrunner and bids are confidential to the bookrunner. Unlike a public issue, the book building route will see a minimum number of applications and large order size per application. The price at which new shares are issued is determined after the book is closed at the discretion of the bookrunner in consultation with the issuer. Generally, bidding is by invitation only to high-net-worth clients of the bookrunner and, if any, lead manager, or co-manager. Generally, securities laws require additional disclosure requirements to be met if the issue is to be offered to all investors. Consequently, participation in a book build may be limited to certain classes of investors. If retail clients are invited to bid, retail bidders are generally required to bid at the final price, which is unknown at the time of the bid, due to the impracticability of collecting multiple price point bids from each retail client. Although bidding is by invitation, the issuer and bookrunner retain discretion to give some bidders a greater allocation of their bids than other investors. Typically, large institutional bidders receive preference over smaller retail bidders, by receiving a greater allocation as a proportion of their initial bid. All bookbuilding is conducted “off-market” and most stock exchanges have rules that require that on-market trading be halted during the bookbuilding process.

The key differences between acquiring shares via a bookbuild (conducted off-market) and trading (conducted on-market) are:

- Bids into the book are confidential vs. transparent bid and ask prices on a stock exchange;

- Bidding is by invitation only (only high-net-worth clients of the bookrunner and any co-managers may bid);

- The bookrunner and the issuer determine the price of the shares to be issued and the allocations of shares between bidders in their absolute discretion;

- All shares are issued or transferred at the same price whereas on-market acquisitions provide for multiple trading prices.

The bookrunner collects bids from investors at various prices, between the floor price and the cap price. Bids can be revised by the bidder before the book closes. The process aims at tapping both wholesale and retail investors. The final issue price is not determined until the end of the process when the book has closed. After the close of the book building period, the bookrunner evaluates the collected bids on the basis of certain evaluation criteria and sets the final issue price.

If demand is high enough, the book can be oversubscribed. In these cases the greenshoe option is triggered.

Book building is essentially a process used by companies raising capital through public offerings, both initial public offers (IPOs) or follow-on public offers (FPOs), to aid price and demand discovery. It is a mechanism where, during the period for which the book for the offer is open, the bids are collected from investors at various prices, which are within the price band specified by the issuer. The process is directed towards both the institutional as well as the retail investors. The issue price is determined after the bid closure based on the demand generated in the process.

One thought on “Statement in Lieu of Prospectus and Book Building”