The main purpose of industry analysis, in the context of strategic choice is to determine the industry attractiveness, and to understand the structure and dynamics of the industry with a view to find out the continued relevance to strategic alternatives that are there before a firm.

It follows that, for instance, if the industry is not, or no longer, sufficiently attractive (i.e. it does not offer long-term growth opportunities), then the strategic alternatives that lie within the industry should not be considered. It also means that alternative may have to be sought outside the industry calling for diversification moves.

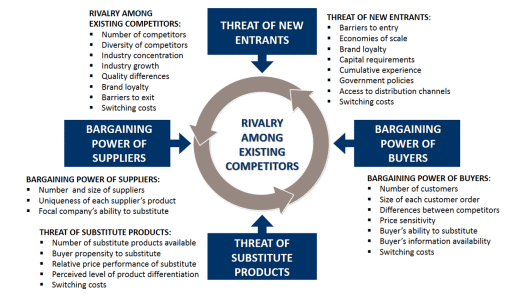

Porter’s Five Forces is a business analysis model that helps to explain why different industries are able to sustain different levels of profitability. The model was originally published in Michael Porter’s book, “Competitive Strategy: Techniques for Analyzing Industries and Competitors” in 1980.

The model is widely used to analyze the industry structure of a company as well as its corporate strategy. Porter identified five undeniable forces that play a part in shaping every market and industry in the world. The forces are frequently used to measure competition intensity, attractiveness and profitability of an industry or market.

These Forces are:

-

Threat of New entrants

This force determines how easy (or not) it is to enter a particular industry. If an industry is profitable and there are few barriers to enter, rivalry soon intensifies. When more organizations compete for the same market share, profits start to fall. It is essential for existing organizations to create high barriers to enter to deter new entrants.

- Low amount of capital is required to enter a market;

- Existing companies can do little to retaliate;

- Existing firms do not possess patents, trademarks or do not have established brand reputation;

- There is no government regulation;

- Customer switching costs are low (it doesn’t cost a lot of money for a firm to switch to other industries);

- There is low customer loyalty;

- Products are nearly identical;

- Economies of scale can be easily achieved.

New entrants raise the level of competition in an industry and reduce its attractiveness. Threat of new entrants depends on barriers to entry. More barriers to entry reduce the threat of new entrants. Some of the key entry barriers are:

- Economies of scale

Industries where the fixed investment is high (such as automobiles), yield higher profits with larger scale of operations. In such industries, established players may have economies of scale of production which new entrants will not have, thus acting as a barrier.

- Capital requirements

Industries that require large seed capital for establishing the business (such as steel) discourage new entrants that cannot invest this amount.

- Switching costs

Customers may face some switching cost like having to buy new spare parts or train employees to run the new machine, in moving from one company to the other, thus discouraging movement of customers from existing players to new entrants.

- Access to distribution

Established players may have access to the most efficient distribution channels. Distribution channel members may not tie up with new entrants who pose competition to their existing partners.

- Expected retaliation

If existing players have large stakes in continuing their business (large investment, substantial revenues, strategic importance), or if they are dominant players, they would retaliate strongly to any new entrant.

- Brand equity

Existing players have established product reputation and built a strong brand image over the years. New players would find it hard to convince customers to switch over to their offering. To incumbent competitors, industry attractiveness can be increased by raising entry barriers. In fact, one of the main objectives of existing players in the industry is to erect strong entry barriers to prevent new competitors from entering the industry.

-

Bargaining Power of Suppliers

Strong bargaining power allows suppliers to sell higher priced or low quality raw materials to their buyers. This directly affects the buying firms’ profits because it has to pay more for materials. Suppliers have strong bargaining power when:

- There are few suppliers but many buyers

- Suppliers are large and threaten to forward integrate

- Few substitute raw materials exist

- Suppliers hold scarce resources

- Cost of switching raw materials is especially high

Bargaining power of suppliers will be high when:

- Many buyers and few sellers

There are many buyers and few dominant suppliers. Suppliers would be in a position to charge higher prices or cause instability in supply of essential products. The buyers should develop more suppliers by agreeing to invest in them and helping them with technologies.

- Differentiated supplies

When suppliers offer differentiated and highly valued components, their bargaining power is higher, since the buyer cannot switch suppliers easily. When many suppliers offer a standardized product, their bargaining power reduces. The buyer should bring the processes that enable the supplier to make differentiated products in-house and buy only standard components from the supplier.

- Crucial supplies

If the product sold by the supplier is a key component for the buyer, or it is crucial for its smooth operations, then the bargaining power of suppliers is higher. The buyer should always keep the production of key components with itself.

- Forward integration

When there is a threat of forward integration into the industry by the suppliers, their bargaining power is higher. There is a strong threat of forward integration when the supplier supplies a very crucial part of the final product. The supplier of engines to an automobile maker is in a very strong position to contemplate making automobiles because it already has expertise over a key component of the final product.

- Backward integration

When there is threat of backward integration by buyers, the bargaining power of suppliers becomes weaker, as the supplier may become redundant if the buyer starts making the same product. The buyer should always have an idea of the technologies that are being employed in making crucial and differentiated products and should be capable of putting together the resources to make these components. Suppliers should always understand that if the buyer is cornered, he will start making the components himself.

- Level of dependence

When the industry is not a key customer group for suppliers, their bargaining power increases. Buyers are dependent on suppliers, though suppliers do not focus on the customer group. The suppliers can survive even when they stop supplying to the buyers as the major part of their business is coming from some other industry. The buyers should be careful in selecting their suppliers. They should select suppliers who have strong stake in the buyers’ industry and not those who only have peripheral interests in the buyers’ industry.

-

Bargaining Power of Buyers

Buyers have the power to demand lower price or higher product quality from industry producers when their bargaining power is strong. Lower price means lower revenues for the producer, while higher quality products usually raise production costs. Both scenarios result in lower profits for producers. Buyers exert strong bargaining power when:

- Buying in large quantities or control many access points to the final customer

- Only few buyers exist

- Switching costs to other supplier are low

- They threaten to backward integrate

- There are many substitutes

- Buyers are price sensitive

Higher bargaining power of customers implies that they can seek greater compliance from the companies of the industry.

- Few dominant customers

When there are few dominant customers and many sellers, customers can exercise greater choice. They also dictate terms and conditions to the supplier. This is true in industrial markets where many suppliers make standard components for a few Original Equipment Manufacturers. The OEMs are able to extract big concessions on price and coerce the suppliers to provide expensive services like just-in-time supplies. The suppliers have to agree to debilitating terms of the buyers if they have to continue to supply to them.

- Non-differentiated products

If products sold by the players in the industry are standardized, or there are little differences among them, buyers can easily switch over to competitors, increasing their bargaining power. This is increasingly happening in consumer markets. Customers are not able to tell one manufacturer’s product from that of another. The result is that the customers are buying mostly on price and the manufacturers are reducing prices to lure customers.

The problem with such an approach is that with reduced profits, a company’s ability to differentiate its product further goes down. The manufacturer is caught in the spiral of low differentiation-low price-low profits- further low differentiation-further low prices-further low profits. The manufacturer has to break this chain and collect resources to differentiate its product so that it can fetch a higher price and profit.

- Small proportion of customer’s total purchase

If the product offered by the firm is not important or critical for the customer, the bargaining power of customers is higher. The product may be of a relatively smaller value in the overall disposable income of the customer. This may work out to be to the advantage of the seller.

The customer will not be overly worried if the supplier raises its price by small amount as the slightly increased expenditure will not be a big dent in the income of the customer. As level of economic prosperity rises, manufacturers of packaged foods and other fast moving consumer goods can increase the quality and price of their products. Customers would not mind paying slightly higher prices for better products.

- Backward integration

Customers may threaten to integrate backward into the industry, and compete with suppliers. This may be a reality in industrial markets but it is very rare in consumer markets. Most customers do not have the resources to start making what they buy.

- Forward integration

Suppliers can threaten to integrate forward into customers’ industry. The customers have to understand and contain the imminent threat of competition from their suppliers. This threat is meaningless in consumer markets but the threat is real in industrial markets, particularly when the supplier is supplying a key component.

- Key supplies

The industry is not a key supplying group for buyers. In consumer markets, one manufacturer supplies only a small fraction of his total purchases.

-

Threat of Substitutes

This force is especially threatening when buyers can easily find substitute products with attractive prices or better quality and when buyers can switch from one product or service to another with little cost. For example, to switch from coffee to tea doesn’t cost anything, unlike switching from car to bicycle.

- Buyer’s willingness to substitute

Buyers will substitute when the industry’s product is not strongly differentiated, so the buyers will not have developed strong preference for the product. In industrial markets, the product should be either enhancing value of the final product it becomes a part of, or is enhancing the operation of the buyer.

- Relative prices and performance of substitutes

If the substitute enhances the operation of the customer without incurring additional costs, substitute product would be preferred.

- Costs of switching over to substitutes

In industrial markets, if a company has to buy another manufacturer’s product, the company will have to buy new spare parts and will have to train its operations and maintenance staff on the new machine.

The substitute products satisfy the same general need of the customer. The customer evaluates various aspects of the substitute products such as prices, quality, availability, ease of use etc. Relative substitutability of products varies among customers. The threat of substitute products depends on how sophisticated the needs of the buyers are, and how strongly entrenched their habits are. Some people will continue to drink coffee, and will never ever switch to drinking tea, no matter how costly coffee may become.

A company can lower threat of substitute products by building up switching costs, which may be monetary or psychological-by creating strong distinctive brand personalities and maintaining a price differential commensurate with perceived consumer value.

-

Rivalry among existing competitors

This force is the major determinant on how competitive and profitable an industry is. In competitive industry, firms have to compete aggressively for a market share, which results in low profits. Rivalry among competitors is intense when:

- There are many competitors

- Exit barriers are high

- Industry of growth is slow or negative

- Products are not differentiated and can be easily substituted

- Competitors are of equal size

- Low customer loyalty

The intensity of rivalry between competitors depends on:

- Structure of competition

An industry witnesses intense rivalry amongst its players, when it has large number of small companies or a few equally entrenched companies. An industry witnesses less rivalry when it has a clear market leader. The market leader is significantly larger than the industry’s second largest player, and it also has a low cost structure.

- Structure of costs

In an industry which has high fixed costs, a player will cut price to attract competitors’ customers to fill capacity. A player may be willing to price just above its marginal cost, and since the industry’s marginal cost is low, it is not unusual to see price cuts of 50-70 per cent Such price cuts are almost always matched by competitors, because all of them are trying to fill capacity. The inevitable result is a price war.

- Degree of differentiation

Players of an industry whose products are commoditized will essentially compete on price, and hence price cuts of a player will be swiftly matched by competitors, resulting in intense rivalry. But when players of an industry can differentiate their products, they understand that customers do not associate the industry’s products with a single price, and that the price of a product is dependent on its features, benefits and brand strength. Players of such an industry compete on features, benefits and brand strength, and hence rivalry is less intense. When a player cuts price, its competitor can react by adding more features, providing more benefits, or hiring a celebrity in its advertisements, instead of cutting price.

- Switching costs

Switching cost is high when product is highly specialized, and when the customer has expended lot of resources and efforts to learn how to use it. Switching cost is also high when the customer has made investments that will become worthless if he uses any other product. Since a customer of a company is not likely to be lured by competitors’ price cuts and other manoeuvres, competitive rivalry is less in such an industry.

- Strategic objectives

When competitors are pursuing build strategies, they will match the price cuts of a player because they do not want to lose market share to the player who has cut price. Therefore, rivalry will be intense. But when competitors are pursuing hold or harvest strategies, they will not be too keen to match the price cuts of a player, because they are more interested in profits than market share. Therefore, rivalry will be less intense.

- Exit barriers

When players cannot leave an industry due to factors such as lack of opportunities elsewhere, high vertical integration, emotional barriers or high cost of closing down a plant, rivalry will be more intense. In such an industry, players will compete bitterly as they do not have the option to quit. But, when exit barriers are low, players who are not good enough, or who have found more attractive industries to enter, can exit. With fewer numbers of players in the industry now, rivalry will be less intense.

Although, Porter originally introduced five forces affecting an industry, scholars have suggested including the sixth force: complements. Complements increase the demand of the primary product with which they are used, thus, increasing firm’s and industry’s profit potential. For example, iTunes was created to complement iPod and added value for both products. As a result, both iTunes and iPod sales increased, increasing Apple’s profits.

One thought on “Porter Five Forces Model”