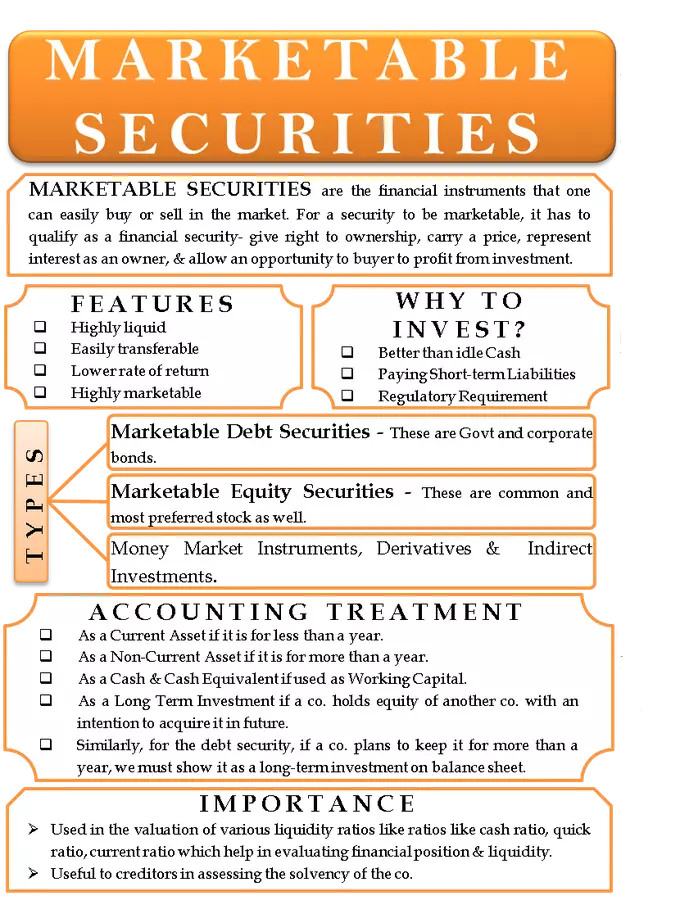

Marketable securities are liquid financial instruments that can be quickly converted into cash at a reasonable price. The liquidity of marketable securities comes from the fact that the maturities tend to be less than one year, and that the rates at which they can be bought or sold have little effect on prices.

Marketable Securities are the financial instruments that one can easily buy or sell in the market. The maturities of these financial instruments are usually less than a year. Since they have high liquidity, these investments are good for businesses that need quick cash. Some examples of these financial instruments are government bonds, common stock or certificates of deposit.

Businesses keep their cash in reserves. Such reserves help them in situations when they require cash, like for acquisitions or any unforeseen payment. However, companies do not put all their cash in the reserves. Instead, they invest some in short-term liquid securities to earn interest. This way, the cash not only earns an interest income, but a company can also easily liquidate the investment to meet any future cash need.

The returns on such securities are relatively lower due to their liquidity and the fact that we see them as safe investments. Apple holds a major portion of its wealth in the form of such securities.

Features

- These are highly liquid, meaning one can easily buy and sell these securities.

- Are easily transferable on a stock exchange or otherwise.

- Offer a lower rate of return.

- These are highly marketable as there are active marketplaces where they can be bought or sold.

Types

Marketable securities broadly have two groups marketable debt securities and marketable equity securities.

-

Marketable debt securities

Marketable debt securities are government bonds and corporate bonds. One can trade these on the public exchange and their market price is also readily available. In the balance sheet, all marketable debt securities are shown as current at the cost, until a company realizes a gain or loss on the sale of the debt instrument.

-

Marketable equity securities

Marketable equity securities are common stock and most preferred stock as well. One can also easily trade them on the public exchanges and their market price information is easily available. All marketable equity securities are shown in the balance sheet at either cost or market whichever is lower.

There is also a third type of marketable securities classified further into three categories – money market instruments, derivatives, and indirect investments. Indirect investments include money put into hedge funds and unit trusts.

Derivatives are the investments that are dependent on another security for their value, like futures, options, and warrants.

Money market securities are short-term bonds, like Treasury bills (T-bills), banker’s acceptances and commercial paper. Big financial entities purchase these in massive quantities.