The Effective Annual Rate (EAR) is the interest rate that is adjusted for compounding over a given period. Simply put, the effective annual interest rate is the rate of interest that an investor can earn (or pay) in a year after taking into consideration compounding.

The Effective Annual Interest Rate is also known as the effective interest rate, effective rate, or the annual equivalent rate. Compare it to the Annual Percentage Rate (APR) which is based on simple interest.

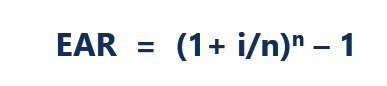

The EAR formula for Effective Annual Interest Rate:

Where:

i = stated annual interest rate

n = number of compounding periods

Importance of Effective Annual Rate

The Effective Annual Interest Rate is an important tool that allows the evaluation of the true return on an investment or true interest rate on a loan.

The stated annual interest rate and the effective interest rate can be significantly different, due to compounding. The effective interest rate is important in figuring out the best loan or determining which investment offers the highest rate of return.

In the case of compounding, the EAR is always higher than the stated annual interest rate.