Significance of financial instruments for financial position and performance

An entity shall disclose information that enables users of its financial statements to evaluate the significance of financial instruments for its financial position and performance.

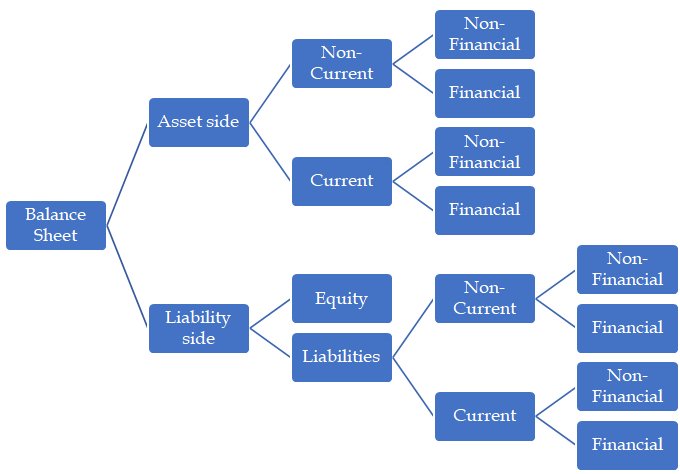

Balance sheet

Categories of financial assets and financial liabilities

The carrying amounts of each of the following categories, as defined in Ind AS 39, shall be disclosed either in the balance sheet or in the notes:

(a) financial assets at fair value through profit or loss, showing separately (i) those designated as such upon initial recognition and (ii) those classified as held for trading in accordance with Ind AS 39;

(b) Held-to-maturity investments;

(c) Loans and receivables;

(d) available-for-sale financial assets;

(e) financial liabilities at fair value through profit or loss, showing separately (i) those designated as such upon initial recognition and (ii) those classified as held for trading in accordance with Ind AS 39; and

(f) Financial liabilities measured at amortised cost.

Financial assets or financial liabilities at fair value through profit or loss

If the entity has designated a loan or receivable (or group of loans or receivables) as at fair value through profit or loss, it shall disclose:

(a) The maximum exposure to credit risk (see paragraph 36(a)) of the loan or receivable (or group of loans or receivables) at the end of the reporting period.

(b) The amount by which any related credit derivatives or similar instruments mitigate that maximum exposure to credit risk.

(c) The amount of change, during the period and cumulatively, in the fair value of the loan or receivable (or group of loans or receivables) that is attributable to changes in the credit risk of the financial asset determined either:

(i) As the amount of change in its fair value that is not attributable to changes in market conditions that give rise to market risk; or

(ii) Using an alternative method the entity believes more faithfully represents the amount of change in its fair value that is attributable to changes in the credit risk of the asset.

Changes in market conditions that give rise to market risk include changes in an observed (benchmark) interest rate, commodity price, foreign exchange rate or index of prices or rates.

(d) The amount of the change in the fair value of any related credit derivatives or similar instruments that has occurred during the period and cumulatively since the loan or receivable was designated.

If the entity has designated a financial liability as at fair value through profit or loss in accordance with paragraph 9 of Ind AS 39, it shall disclose:

(a) The amount of change, during the period and cumulatively, in the fair value of the financial liability that is attributable to changes in the credit risk of that liability determined either:

(i) As the amount of change in its fair value that is not attributable to changes in market conditions that give rise to market risk (see Appendix B, paragraph B4); or

(ii) Using an alternative method the entity believes more faithfully represents the amount of change in its fair value that is attributable to changes in the credit risk of the liability.

Changes in market conditions that give rise to market risk include changes in a benchmark interest rate, the price of another entities financial instrument, a 5

Commodity price, a foreign exchange rate or an index of prices or rates. For contracts that include a unit-linking feature, changes in market conditions include changes in the performance of the related internal or external investment fund.

(b) The difference between the financial liabilities carrying amount and the amount the entity would be contractually required to pay at maturity to the holder of the obligation.

The entity shall disclose:

(a) The methods used to comply with the requirements in paragraphs 9(c) and 10(a).

(b) If the entity believes that the disclosure it has given to comply with the requirements in paragraph 9(c) or 10(a) does not faithfully represent the change in the fair value of the financial asset or financial liability attributable to changes in its credit risk, the reasons for reaching this conclusion and the factors it believes are relevant.

Reclassification

If the entity has reclassified a financial asset (in accordance with paragraphs 5154 of Ind AS 39) as one measured:

(a) At cost or amortised cost, rather than at fair value; or

(b) At fair value, rather than at cost or amortised cost,

It shall disclose the amount reclassified into and out of each category and the reason for that reclassification.

12A. if the entity has reclassified a financial asset out of the fair value through profit or loss category in accordance with paragraph 50B or 50D of Ind AS 39 or out of the available-for-sale category in accordance with paragraph 50E of Ind AS 39, it shall disclose:

(a) The amount reclassified into and out of each category;

(b) For each reporting period until derecognition, the carrying amounts and fair values of all financial assets that have been reclassified in the current and previous reporting periods;

(c) If a financial asset was reclassified in accordance with paragraph 50B, the rare situation, and the facts and circumstances indicating that the situation was rare;

(d) for the reporting period when the financial asset was reclassified, the fair value gain or loss on the financial asset recognised in profit or loss or other comprehensive income in that reporting period and in the previous reporting period;