Cost center includes a production or service location, function, activity or plant item in relation to which costs are determined. It may include a single expensive machine, a group of these machines and may be extended to individual departments or even the whole factory may be treated as a cost center in some cases. There are two types of cost center:

(1) Production Cost Centers:

Production cost centers are the cost centers directly involved in the manufacturing operations. Examples include molding, machining, assembly, shaping, welding, binding, cutting, etc.

(2) Service Cost Centers:

Service cost centers are incidental to the production process as products or cost units are not produced by them. However these are although necessary for it to take place. Examples are canteen, personnel, stores, boiler house and maintenance, etc. Any cost which is incurred or charged to service cost centers must be reapportioned subsequently to production cost centers for absorbing overheads in the total costs of the product.

Cost Unit

We cannot have costs unless there are things to be costed. Cost unit is a unit of output (or a unit of service provided) which absorbs the cost center’s overhead cost.

Often the cost units are the final products manufactured by the organization, e.g., vehicles for a vehicle manufacturer, passenger-mile in a transport business, operation in a hospital are examples of a cost unit.

The cost unit is not necessarily restricted to the final product of the organization, however, if the final cost unit is either big or complex the costing system may be organized so that the costing of intermediate parts or sub-assemblies may take place. In these cases, each part which is costed may be treated as a cost unit.

Where small units of output are produced,it is usual to combine the output into batches so that the cost unit does not have a cost which is so small as to be immeasurable. Examples include thousands of pens may be a cost unit for a pen manufacture company and tonnes of newspaper publishers.

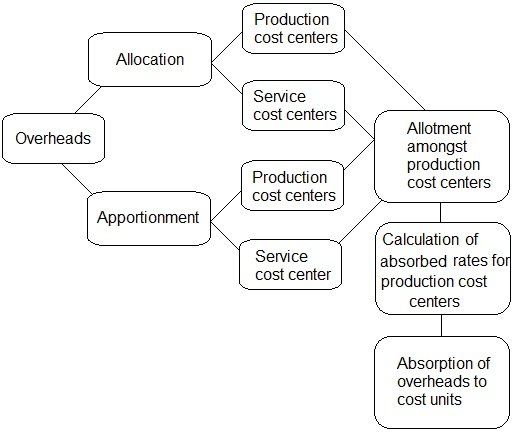

Steps to Calculate Overhead Cost Per Unit (or Determination of Overhead Absorption):

The following steps are undertaken to determine the overhead costs to charge to production cost units.

(i) Record all estimated overheads.

(ii) Classify all overheads as variable, fixed or mixed.

(iii) Charge cost units to direct costs as they are directly attributed to cost units.

(iv) Allocate or apportion indirect cost to production or services cost centers.

(v) Reallocate cost of service cost centers among production cost centers to get total overheads of production cost centers.

(vi) Determine an estimated budgeted level.

(vii) Calculate an overhead absorption (recovery) rate by dividing the total budgeted overheads by the total budgeted activity level.

(viii) Assign production overheads to production units by applying overhead rate.

(ix) Calculate total costs by adding indirect and direct costs.

One thought on “Cost center”