Break-even analysis entails the calculation and examination of the margin of safety for an entity based on the revenues collected and associated costs. Analyzing different price levels relating to various levels of demand a business uses break-even analysis to determine what level of sales are necessary to cover the company’s total fixed costs. A demand-side analysis would give a seller significant insight regarding selling capabilities.

Some of the popular definitions of break-even analysis are as follows:

According to Matz, Curry and Frank, “a break-even analysis indicates at what level, cost and revenue are in equilibrium.”

According to Keller and Ferrara, “the break-even point of a unit of a company is the level of sales income which will equal the sum of its fixed costs and its variable costs.”

According to Charles T. Homogreen, “the break-even point of activity (sales volume) is where total revenue and total expenses are equal. It is the point of zero profit and zero loss.”

The important aspect of understanding break-even analysis is the break-even point at which there is no net loss or gain of an organization as expenses equals revenue.

Mathematically, relationships can be expressed as follows:

Break-even-point = Fixed costs/ Contribution per unit

Contribution = Sale price per unit—variable costs per unit

Margin of safety = Total sale proceeds—sales at B.E.P

Profit = Sales—Total costs (fixed + variable) or

= Total Contributions-Fixed Costs

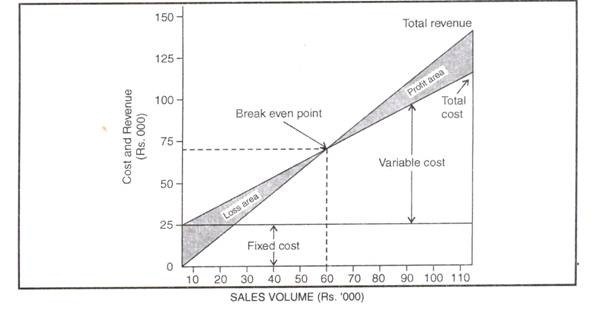

Break-Even Chart

Break even chart shows the profitability (or otherwise) of an undertaking at various levels of activity and as a result indicates the point at which there will be neither a profit nor loss. The break even chart is a graphic chart which ‘presents the varying costs along with the changing sales revenue, indicates the sales volume at which cost are fully covered by revenue, and reveals the estimated profits or loss which will be realised at different levels of activity.

Breakeven point refers to the point on the break even chart at which cost is equal to the sales revenue. It is also known as the point of ‘no profit no loss’. This is clearly illustrated in the diagram on next page.

In the following diagram sales volume are shown on x-axis and cost and revenue are shown on y-axis. The fixed costs are represented by horizontal line. The total cost of sales is represented by the fixed cost line. It moves upward proportionately with the volume.

The sales revenue is represented by the line moving upward uniformally from the origin of the axes. The point of interaction of the total cost line with revenue line is the breakeven point.

The main advantage of break even analysis is that it tells about probable level of profits at different levels of output. It clearly indicates the inter-relationship between revenue, cost and profit in graphic form which is easily understood. It also reflects the comparative significance of fixed and variable costs.

The main limitation of this method is that it takes into consideration fixed and variable costs but semi-variable cost and their impact are not considered at all. Scope of break even analysis is limited to cost-volume and profits but it ignores other considerations such as capital amount, marketing aspects and effects of government policy etc., which are necessary in decision-making and price determination.

It is assumed under this method that fixed costs remain unchanged, but in reality they do not remain the same in the long run and changes take place in response to technological developments, size of the concern and other factors.

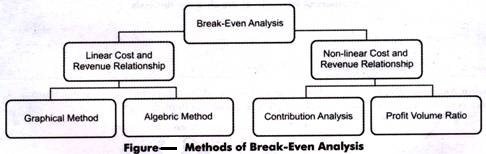

Methods of Break Even Analysis

-

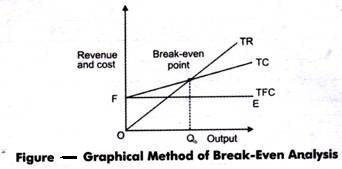

Graphical Method

When price of a product remains the same, the organization expands its production, thus, total revenue is linear to the output.

As shown in Fig. TFC is equals to FE, which is a fixed cost line. The vertical distance between TC and TFC line equals TVC. As quantity of output increases, the vertical distance between TC and TFC increases. This implies that TVC increases with change in TC and TFC.

Until Qb of the quantity is produced, total cost exceeds the total revenue, which implies that an organization will suffer losses if it produces less than Qb. At Qb output level, total revenue equals total cost. At this point, an organization never makes profit nor loss implying that it is a break-even point. Thus, Qb is a break-even level of output. Producing more than Qb will be profitable for organizations as TR is greater than TC.

-

Algebraic Method

Helps in decision making problems of the organization. We know that profit is equal to difference between total revenue and total cost.

π = TR – TC

TR = P*Q

TC = TVC + TFC

TC = AVC*Q + TFC (TVC is the variable cost per unit multiplied by the output produced and sold)

Let Qb is the break-even quantity at which TR = TC.

TR = TC

Qb = TFC + AVC. Qb

P.Qb – AVC.Qb = TFC

(P – AVC)Qb = TFC

Qb = TFC/ (P-AVC)

Thus, from the above equation, it can be said that the break-even quantity of output is determined by TFC, price and variable cost per unit of output.

-

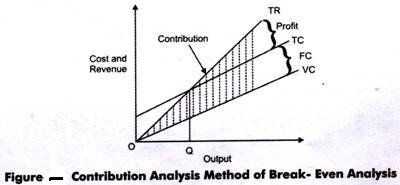

Contribution Analysis

Refers to the analysis of incremental or additional revenue and costs of a business. Contribution is the difference between total revenue and variable costs.

Fixed costs are addition to variable costs. Thus, TC line is parallel to the variable costs line. In the fig. OQ is the break-even point. TC minus VC equals FC. Below OQ, contribution is less than fixed cost whereas beyond OQ, contribution exceeds faxed cost. The shaded portion between TR and VC is the contribution.

-

Profit volume (PV) ratio

Refers to another method to find break-even point. The formula for profit volume ratio is:

PV ratio = (S-V)/S* 100

S = Selling price

V = Variable costs

2 thoughts on “Break Even Analysis”