Accounting Treatment in the Books of Transferor/Vendor Company:

So far as the books of the transferor company are concerned, the normal procedures are to be followed for closing the books of account through Realisation Account. It should be noted that the Accounting Standard (AS-14) deals with the accounting procedures only in the books of the transferee company.

In case of amalgamation the transferor company has to wind up its business and hence it will dispose off its assets, pay its liabilities and distribute the surplus if any among its shareholders. It is done through opening a new account known as Realisation Account. In order to close the books of account of the transferor company, the following steps (along with their journal entries) are required:

Step 1:

Open a Realisation Account, transfer all assets and liabilities (excluding fictitious assets) to this account.

Journal Entry:

For transferring different assets to Realisation Account.

- Realisation A/c Dr. (with total)

To Sundry assets (individually) (with their individual values)

Points to be noted:

(a) Fictitious assets, such as preliminary expenses, discount on issue of shares and debentures, debit balance of Profit and Loss Account etc. are not transferred to Realisation Account.

(b) In tangible assets such as goodwill, patents, trademarks etc. are also transferred to Realisation Account.

(c) The cash and bank balances should not be transferred to Realisation Account if these are not taken over by the purchasing company.

(d) An asset against which a provision or reserve has been created should be transferred at its gross figure and not at its net figure e.g. debtors.

Step 2:

For transferring different liabilities to Realisation Account.

Sundry Liabilities Dr. [with their individual book values]

To Realisation A/c [with the total]

Points to be noted:

(i) Items in the nature ‘Provisions’ (e.g. Provision for taxation, Employees provident fund, Pension Fund, Provision for doubtful debts, Provision for Depreciation) should be transferred to Realisation Account.

(ii) Items in the nature of ‘Reserve’ are not to be transferred to Realisation Account. These are directly transferred to sundry shareholders account (e.g. workmen compensation fund, credit balance of profit and loss account).

(iii) A liability against which a provision or reserve has been created should be transferred at its gross figure e.g. creditors.

Step 3:

For realising assets which have not been taken over by the purchasing company.

Cash or Bank Account Dr. (with the amount realised)

To Realisation account

Step 4:

For discharging liabilities, which have not been taken over by the purchasing company.

Realisation A/c Dr. (with the amount paid)

To Cash

Step 5:

To record liquidation expenses

| (a) | If these expenses are borne by the transferor company | Journal Entry

Realisation Account |

Dr. |

| To Bank |

| (b) | If these are paid by the purchasing companies directly | No Entry | |

| © | If these expenses are first paid by the transferor company and later reimbursed by the transferee company | ||

| 1. On Payment by the transferor company | Transferee company’s account

To Realization account |

Dr. | |

| 2. On reimbursement | Bank Account

To Realization account |

Dr. |

Step 6:

For Receiving Purchase Consideration

| Cash/Bank Account | Dr. | With cash received |

| Preference Shares in Purchasing Company | Dr. | With issue price of preference shares |

| Equity Shares in Purchasing Company | Dr. | With issue price of equity shares

With the total |

| To Transferee Company |

Step 7:

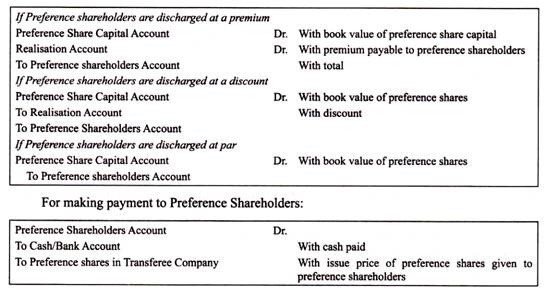

Discharge the claims of preference shareholders and transfer the difference between the amount actually payable and the book figure to Realisation Account

Journal Entries for making the payment due:

Step 8:

Ascertain the profit/loss on realisation and transfer the same to equity shareholders account

| In Case of Profit | Realisation Account (With profit)

To Equity Shareholders Account |

| In case of loss | Equity Shareholders Account

To Realisation Account (With loss) |

Step 9:

Transfer Equity share capital, Accumulated profits and Reserves shown in the Balance Sheet (just before date of amalgamation) to Equity Shareholders Account

| Equity Share Capital Account | Dr. | With paid up value of Share Capital |

| Profit and Loss Account | Dr. | With credit balance of profit and loss Account |

| General Reserve Account | Dr. | If Any |

| Workmen Compensation fund Account | Dr. | If any |

| Capital Reserve Account | Dr. | If any |

| Dividend Equalisation Fund Account | Dr. | If any |

| Securities Premium Account | Dr. | If any |

| Debenture Redemption Reserve Account | Dr. | If any |

| Capital Redemption Reserve Account | Dr. | If any |

| To Equity Shareholders Account | With total |

Step 10:

Transfer Accumulated losses (shown on debit side of Balance Sheet just before amalgamation)

| Equity Shareholders Account | Dr. | |

| To Profit and Loss Account | Debit balance | |

| To Preliminary Expenses Account | If Any | |

| To Discount on issue of Shares/Debentures | If Any | |

| To deferred Revenue Expenditure Account | If Any |

Step 11:

Make the final payment to equity shareholders

| Equity Shareholders Account | Dr. | With total |

| To Equity shares in transferee company’s Account | No. of Shares issued X Issue price per share | |

| To Cash/Bank Account | With cash paid |

Notes:

- After passing the above-mentioned entries in books of Transferor Company, all the accounts will be closed and not a single account will show any balance.

- The net amount payable to equity shareholders must be equal to the amount of shares in Transferee Company and cash and bank balance left after the discharge of all outsiders’ liabilities and claims of preference shareholders.

Accounting Treatment in Books of Transferee Company or Purchasing Company:

Accounting treatment in books of Transferee Company depends upon the type of amalgamation.

As per AS-14, there are two methods of accounting for amalgamation:

- Pooling of Interest Method:

Applicable in case of Amalgamation in the nature of merger.

- Purchase Method:

Applicable in case of Amalgamation in the nature of Purchase.

Pooling of Interest Method (as per AS-14):

The following are the salient features of pooling of interest method:

- All assets, liabilities and reserves of the transferor company are recorded by the transferee company at their existing carrying amounts (book values) except in cases where these are to be adjusted to follow uniform set of accounting policies.

- The identity of the reserves is preserved as they appear in financial statements of the transferee company. For example, the general reserve of the transferor company becomes the general reserve of the transferee company, the capital reserve of the transferor company becomes the capital reserve of the transferee company and the revaluation reserve of the transferor company becomes the capital reserve of the transferee company.

- No goodwill account should be accounted for as a result of amalgamation in the books of the transferee company.

- The difference between the amount of share capital issued (plus any additional consideration in the form of cash or other assets) and the amount of share capital of Transferor Company should be adjusted in reserves in the financial statements of the transferee company.

- The balance of profit and loss account appearing in the financial statements of the transferor company is aggregated with the corresponding balance appearing in the financial statements of the transferee company.

- Although AS-14 does not specifically state, the purchase consideration under this method is to be valued at par value of shares issued. The logic is that this method considers book values and not the fair values.