Cost of issuing Commercial Paper

Commercial paper is a commonly used type of unsecured, short-term debt instrument issued by corporations, typically used for the financing of payroll, accounts payable and inventories, and meeting other short-term liabilities. Maturities on commercial paper typically last several days, and rarely range longer than 270 days.

Commercial paper is usually issued at a discount from face value and reflects prevailing market interest rates.

- Investments in such securities are made by institutional investors and high net worth individuals (HNI) directly & by others through mutual funds or exchange-traded funds (ETF).

- It is not meant for the general public, and hence, there is a restriction on the advertisement to market the securities. A secondary market also exists for commercial papers, but the market players are mostly financial institutions.

- It is issued at a discount to the face value, and upon maturity, the face value becomes the redemption value. It is issued in large denominations, e.g., $100,000.

- The maturity of commercial paper ranges from 1 to 270 days (9 months), but usually, it is issued for 30 days or less. Some countries also have a maximum duration of 364 days (1 year). The higher the duration, the higher, is the effective rate of interest on these papers.

- There is no need to register the papers with the Securities Exchange Commission (SEC), and hence, it helps in saving the administrative expenses

- and results in lesser filings.

As per the Uniform Commercial Code (UCC), commercial papers are of four kinds:

Draft: A draft is a written instruction by a person to another to pay the specified amount to a third party. There are 3 parties in a draft. The person who gives the instructions is called “drawer.” The person who is instructed is called “drawee.” The person who has to receive the payment is called the “payee.”

Check: This is a special form of the draft where the drawee is a bank. There are certain special rules which apply to a check. Hence this is considered to be a different instrument.

Note: In this instrument, a promise is made by one person to pay another a certain sum of money to another. There are 2 parties in a note. The person who makes the promise and writes the instrument is called “drawer” or “maker.” The person to whom the promise is made and to whom payment is to be made is called “drawee” or “payee.” It is also known as “promissory note.” In most instances, a commercial paper is in the form promissory note.

Certificates of Deposit (CD): A CD is an instrument wherein the bank acknowledges the receipt of deposit. Further, it also carries details about maturity value, interest rate, and maturity date. It is issued by the bank to the depositor. It is a special form of the promissory note. There are certain special rules which apply to a CD. Hence this is considered to be a different instrument.

Formula for Yield Commercial Paper:

Yield = (Face Value – Sale Price/ Sale Price) * (360/Maturity Period) * 100

There are two types of commercial papers:

Secured Commercial Papers: These are also known as Asset-backed commercial papers (ABCP). These are collateralized by other financial assets. These are normally issued by creating a Structured Investment vehicle that is set up by the sponsoring organization by transferring certain financial assets. These papers are issued to keep off the instruments from the financial statement of the sponsor organization. Further, the rating agencies rate the issue on the basis of the assets kept in the Structured Investment Vehicle, ignoring the asset quality of the sponsor. During the financial crisis, ABCP holders were one of the biggest loss-makers.

Unsecured Commercial Papers: These are also known as traditional commercial papers. Most of these papers are issued without any collateral, and hence, they are unsecured. The rating of the issue depends upon the asset quality and all other aspects relating to that organization. Rating is done in the same manner in which it is done for the bonds. These are not covered by the deposit insurance, e.g., Federal Deposit Insurance Corporation (FDIC) insurance in the U.S., and hence, investors obtain insurance from the market separately as a backup.

Benefits:

- No security is required.

- Interest rate is typically less than that required by banks or finance companies.

- Commercial paper dealer often offers financial advice.

- It is a simple instrument.

- Very less documentation between the issuer and the investor.

- It is flexible in terms of maturities of the underlying promissory note.

- It can be tailored to match the cash flow of the issuer.

- A good credit rated company can diversify its sources of finance from banks to the short-term money market at a cheaper cost.

- For the investors, higher returns obtained than if they invest their funds in any bank.

- For the companies, they are better known to the financial world and hence placed in a better position to borrow long-term funds in future.

- There is no limitation on the end-use of funds raised through commercial papers.

- They are highly liquid.

Cost of issuing Trade Credit

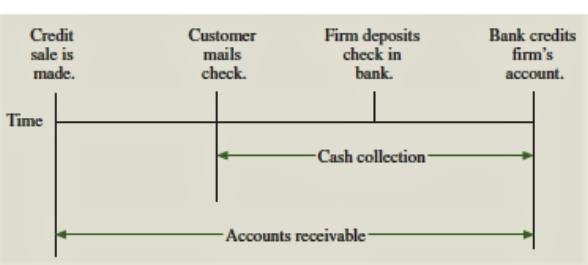

A trade credit is an agreement or understanding between agents engaged in business with each other that allows the exchange of goods and services without any immediate exchange of money. When the seller of goods or services allows the buyer to pay for the goods or services at a later date, the seller is said to extend credit to the buyer.

Trade credit is usually offered for 7, 30, 60, 90, or 120 days, but a few businesses, such as goldsmiths and jewelers, may extend credit for a longer period. The terms of the sale mention the period for which credit is granted, along with any cash discount and the type of credit instrument being used.

One thought on “Cost of issuing Commercial Paper and Trade Credit”