Market Profitability analysis

16/08/2021 0 By indiafreenotesProfitability analysis is especially useful and essential for growing companies. Profitability analysis help businesses identify growth opportunities; since things aren’t as stable yet as compared to a more established business, profitability analysis can spell the difference between shutting down and keeping afloat. In the long run, profitability analysis can help propel that business into the future, and allow that business to grow the potential that allowed it to exist in the first place.

Profitable Customer or Market

A profitable customer is a person, organisation, business or a company that over time yields revenue that exceeds, by an acceptable amount, the cost of attracting, selling and servicing that customer.

A profitable market is a market for the business that over time yields revenue that exceeds, by an acceptable amount, the cost of attracting, selling and servicing the group of customers with which they trade within that market.

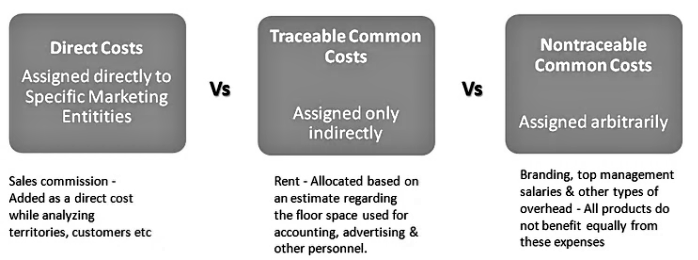

Cost Allocation

Direct costs are those costs incurred to generate revenue, such as the purchase or production cost of units sold or services delivered

Indirect costs or overheads are those costs that cannot be directly attributed to generating revenue, such as the cost of finance, marketing, communications and administration.

The challenge of any profitability analysis is to find a way of allocating the indirect costs to the significant customers or markets. To allocate indirect costs fairly, the key drivers for those costs need to be identified. Examples of drivers for indirect cost are:

- Labour cost or time

- Revenue

- Production cost or time

- Time spent servicing the customers or markets

- The number of transactions, such as purchase orders or sales orders.

Profitability control

This is simply because profit is like money in the bank. For a bootstrapped company, profit may be the corporation’s only capital. For an invested company, financing can be used to sustain a company for a certain period of time but ultimately it is a liability, not an asset. Therefore, businesses need to analyse the profitability of their various products, regions, customer groups and channels.

Past research over the years has shown that:

- 20-40 percent of a company’s products are unprofitable and up to 60 percent of their accounts generate losses

- More than half of customer relationships are not profitable. Also, 30-40 percent are only marginally profitable. More often than not, a mere 10-15 percent of company’s relationships generate most of its profits.

Identifying the functional expenses

The company needs to determine the expenses being incurred for the marketing activities such as selling, advertising, distribution, packing, billing, and collection, et al. Next task is to break each expense and allocate it to different marketing functions. For example, if most salary went to sales representatives and rest went to advertising manager, packing, office accountant, then the total salary will be allocated according to these activities. Finally, all the natural expenses of salary, rent, etc are mapped onto each functional expense of say, selling, advertising, billing, etc.

Assigning the functional expenses to the marketing entities

The next step in the Marketing-Profitability Analysis is to measure how much functional expense is associated with each type of channel. For example, based on the number of orders placed through each channel, the company can allocate accounting expenses. Also, based on the number of ads placed for each channel, the advertising expense can be allocated. This way an average cost can be calculated based on the total number of ads. Based on the amount of sales efforts required for each channel, the cost for the sales calls can be allocated to the specific channel.

Preparing a profit-and-loss statement for each marketing entity

The last step is to prepare a profit and loss statement for each type of channel. The cost of goods is assigned according to the number of sales for each channel, e.g. if one channel achieved half of the total sales then the cost of goods allocated to that channel will be half of the total cost of goods sold.

From this gross margin, one can deduct the proportion of each of the functional expenses including selling, advertising, billing, packing, etc. This overall calculation will give the net profit for each of the channels. The key inference from this calculation is that the gross sales from a specific channel does not equate to a higher profit from that same channel.

While determining the correcting action based on the profit and loss statement, the company also needs to consider factors related to buyers, market trends, marketing strategies, etc. before concluding which channels are the best to continue investing in and which channels need to be dropped. Marketing management can evaluate alternative actions more specific to the channels that are not doing so well.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- More