Time keeping

- Preparation of Pay Rolls in case of time-paid workers.

- Meeting the statutory requirements.

- Ensuring discipline in attendance.

- Recording of each worker’s time ‘in’ and ‘out’ of the factory making distinction between normal time, overtime, late attendance and early leaving.

- for overhead distribution when overheads are absorbed on the basis of labour hours.

Time Recording for Piece Workers:

Recording of time in case of piece workers is necessary due to the following reasons:

- Workers should come and leave the factory in time, as there cannot be a uniform flow of production if workers come late or leave early. Time cards should be maintained for piece workers to ensure discipline otherwise workers who are paid by time are likely to be dissatisfied.

- Time cards are to be maintained for piece workers if they are guaranteed a minimum payment for the time spent by them irrespective of their output.

- Time recoding is essential if apportionment of overheads is made on the basis of labour hours.

- Time recording is essential because it facilitates the calculation of overtime wages, dearness allowance leave with pay and production bonus.

- Time recording facilitates the fixation of differential piece rates.

- Time recording is necessary when statistical records of time may be required for research or complying with legal requirements.

Essentials of a good Time-keeping System

- Good time keeping system prevents ‘proxy’ for one another among workers

- Time-keeping has to be done for even piece workers to maintain uniformity, regularity and continuous flow of production.

- Both the arrival and exit of workers is to be recorded so that total time spent by workers is available for wage calculations.

- Mechanised methods of time keeping are to be used to avoid disputes.

- Late arrival time and early departure time are to be recorded to maintain discipline.

- The time recording should be simple, quick and smooth.

- Time recording is to be supervised by a responsible officer to eliminate irregularities.

Methods of time keeping

- Time Recording Clocks or Clock Cards: This is mechanized method of time recording. Each worker punches the card given to him when he comes in and goes out. The time and date is automatically recorded in the card. Each week a new card is prepared and given to the worker so that weekly calculation of wages will be possible.

- Disc Method: This is one of the older methods of recording time. A disc, which bears the identification number of each worker, is given to each one. When the worker comes in, he picks up his disc from the tray kept near the gate of the factory and drops in the box or hooks it on a board against his number. Same procedure is followed at the time of leaving the factory. The box is removed at starting time, and the time keeper becomes aware of late arrivals by requiring the workers concerned to report him before starting. The time keeper will record in an Attendance Register any late arrivals and workers leaving early. He will also enter about the absentees in the register on daily basis.

- Attendance Records: This is the simplest and the oldest method of marking attendance of workers. In this method, every worker signs in an attendance register against his name. Leaves taken by workers as well as late reporting is marked on the attendance register itself.

Time booking

Time booking signifies the time spent by a worker on each job, process or operation. It is more important in case of direct workers as compared to indirect workers.

Objectives of Time-Booking:

(i) To calculate the labour cost of jobs done;

(ii) To apportion overheads against jobs;

(iii) To evaluate performance of labour and to make comparison of actual labour time with budgeted time;

(iv) To ascertain idle time for the purpose of control;

(v) To determine overhead rates for absorbing overhead expenses under labour hour and machine hour methods; and

(vi) To calculate bonus and wages provided the system of payment of wages depends on the time taken.

Methods of Time-Booking:

(i) Daily time sheets:

It gives in detail the activities of the worker and the time spent in each job. One sheet is allotted to each worker and a daily record is made therein. It is suitable for small organisation where the number of employee and job is small.

(ii) Weekly Time Sheets:

Each worker is given a time sheet wherein jobs done in a week are recorded. It is quite similar to Daily Time Sheet. It reflects a consolidation of the total hours worked during a particular week. This method is useful where there are few jobs in a work.

(iii) Job Cards or Job Tickets:

A separate job card for each job or operation is prepared. This card is allotted to each worker whenever a worker takes up a particular job. In this card the worker enters the time of commencement of a job as well as time of finishing the job. The entries in the job card may be made with the help of machines like time-recording clock.

Treatment of idle time:

Idle time means the amount of time the workers remain idle in a normal working day. The idle time is usually caused by a sudden fault in machine or equipment, power failure, lack of orders for the product, inefficient work scheduling, defective materials and shortage of raw materials etc. The cost associated with idle time is treated as indirect labor cost and should, therefore, be included in manufacturing overhead cost. For example, the normal weekly working hours of a worker are 48 and he is paid @ $8 per hour. If he remains idle for 6 hours due to power failure, then the cost of 42 hours would be treated as direct labor cost and the cost of 6 hours (idle time) would be treated as indirect labor cost and included in manufacturing overhead cost.

| Direct Labor | 336 $ |

| Manufacturing overhead (6 hours* 8$) | 48 $ (idle Time) |

| Total cost | 384 $ |

Treatment of overtime premium:

Overtime premium is the amount that is paid, for the overtime worked, in excess of the normal wage rate. Like idle time, overtime premium is also treated as indirect labor cost and included in manufacturing overhead cost. For example, a worker normally works for 48 hours per week @ $8 per hour. In a particular week, if he works for 52 hours and company pays him $12 for every hour worked in excess of 48 hours, the allocation of the labor cost of the worker would be made as follows:

| Direct Labor (52hrs * 8$ | 416 $ |

| Manufacturing overhead (4 hours* 4$) | 16 $ (idle Time) |

| Total cost | 432 $ |

The amount of $16 is overtime premium and is a part of manufacturing overhead cost.

Treatment of labor fringe benefits:

Fringe benefits are benefits that employers provide to employees in addition to normal salaries or wages. Examples of fringe benefits are hospitalization, insurance programs, retirement plans, paid holidays and stock options etc. Most of the companies treat labor fringe benefits as indirect labor and, therefore, include them in manufacturing overhead costs.

A few firms treat direct labor related fringe benefits as addition to direct labor cost which is considered a more superior practice.

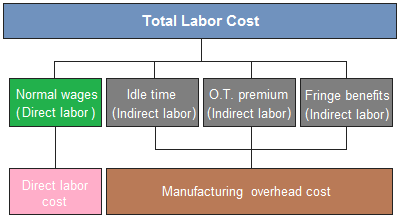

The above information has been summarized below:

2 thoughts on “Treatment of idle times, Overtime Premium, fringe Benefits”