Theories of Corporate Governance

06/05/2021 2 By indiafreenotesCorporate Governance theories encompass various perspectives and frameworks that guide the structure, processes, and relationships within corporations to ensure accountability, transparency, and fairness. These theories have evolved over time in response to changes in business environments, regulatory frameworks, and societal expectations.

-

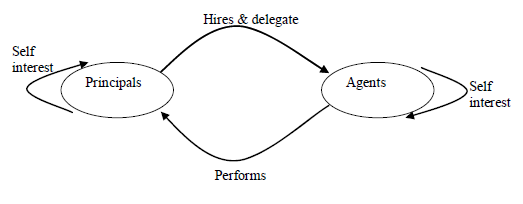

Agency Theory

Developed in the 1970s, agency theory addresses the principal-agent problem, which arises when the interests of shareholders (principals) diverge from those of managers (agents). According to this theory, managers may act in their own interests rather than maximizing shareholder value. Mechanisms such as executive compensation, board oversight, and disclosure requirements are employed to align the interests of managers with those of shareholders.

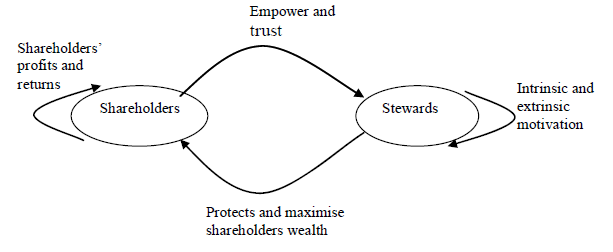

- Stewardship Theory

In contrast to agency theory, stewardship theory suggests that managers are inherently trustworthy and will act in the best interests of shareholders. It emphasizes the importance of building trust between managers and shareholders, as well as fostering a sense of stewardship and responsibility among managers. Stewardship theory advocates for less monitoring and control mechanisms, relying instead on shared values and long-term relationships.

-

Stakeholder Theory:

Stakeholder theory expands the focus of corporate governance beyond shareholders to include all stakeholders who are affected by or can affect the corporation, such as employees, customers, suppliers, communities, and the environment. It argues that corporations should consider the interests of all stakeholders and seek to create value for them, not just shareholders. Stakeholder theory emphasizes corporate social responsibility (CSR) and sustainable business practices.

-

Resource Dependence Theory:

Resource dependence theory examines how corporations interact with their external environment to acquire the resources they need for survival and growth. It suggests that corporations are dependent on various stakeholders for resources such as capital, labor, technology, and information. Effective corporate governance involves managing these dependencies through strategic relationships, alliances, and diversification strategies.

-

Transaction Cost Economics:

Transaction cost economics (TCE) focuses on the costs associated with conducting economic transactions within organizations. It suggests that firms exist to minimize transaction costs, which include the costs of negotiating, monitoring, and enforcing contracts. Corporate governance mechanisms such as vertical integration, outsourcing, and the choice of organizational structure are influenced by TCE principles to mitigate transaction costs.

-

Institutional Theory:

Institutional theory examines how corporations are influenced by social, cultural, and institutional contexts. It suggests that corporate governance practices are shaped not only by economic factors but also by institutional norms, regulations, and societal expectations. Institutional theorists argue that corporations conform to prevailing institutional norms to gain legitimacy and support from stakeholders.

-

Ethical Leadership Theory:

Ethical leadership theory emphasizes the role of leaders in shaping the ethical culture of organizations. It suggests that ethical leaders who demonstrate integrity, transparency, and accountability set the tone for ethical behavior throughout the organization. Corporate governance mechanisms such as codes of conduct, ethics training, and whistleblower protection aim to promote ethical leadership and decision-making.

-

Dynamic Capabilities Theory:

Dynamic capabilities theory focuses on a firm’s ability to adapt and innovate in response to changing market conditions and competitive pressures. It suggests that corporate governance should facilitate the development of dynamic capabilities by fostering a culture of learning, experimentation, and risk-taking. Flexibility, agility, and responsiveness are key principles of dynamic capabilities theory.

-

Legitimacy Theory:

Legitimacy theory argues that corporations must maintain legitimacy in the eyes of society to secure their continued existence and success. It suggests that corporate governance practices are influenced by the need to gain and maintain legitimacy through compliance with legal, ethical, and social norms. Transparency, accountability, and corporate social responsibility are central to legitimacy theory.

-

Network Theory:

Network theory explores the relationships and interdependencies among actors within corporate networks, such as boards of directors, executive teams, investors, and other stakeholders. It suggests that corporate governance effectiveness depends on the strength and quality of these networks, as well as the flow of information and resources among network members. Network theory emphasizes the importance of social capital and relational governance mechanisms.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- More

[…] VIEW […]

[…] VIEW […]