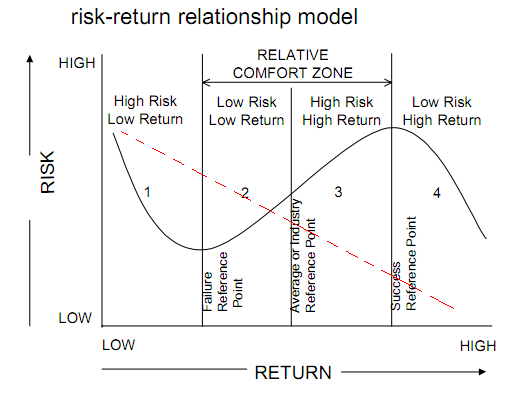

Investments with high risk tend to have high returns and vice versa. Another way to look at it is that for a given level of return, it is human nature to prefer less risk to more risk. Therefore, the higher the risk of an investment, the higher its returns have to be to attract investors.

The risk-return relationship is a fundamental concept in finance and investment theory, emphasizing that the potential return on an investment is usually directly correlated with the level of risk associated with it. This means that higher risk is typically associated with the potential for higher returns, and conversely, lower risk is associated with lower potential returns. Understanding this relationship is crucial for investors as it helps in making informed decisions that align with their investment goals, risk tolerance, and time horizon.

-

Direct Relationship between Risk and Return

The direct relationship between risk and return is a fundamental principle in finance that indicates as the level of risk increases, the potential for higher returns also increases, and vice versa. This principle operates under the assumption that rational investors need to be compensated for taking on higher levels of risk, as there is a greater uncertainty associated with achieving the expected return.

(A) High Risk – High Return

According to this type of relationship, if investor will take more risk, he will get more reward. So, he invested million, it means his risk of loss is million dollar. Suppose, he is earning 10% return. It means, his return is Lakh but he invests more million, it means his risk of loss of money is million. Now, he will get Lakh return.

(B) Low Risk – Low Return

It is also direct relationship between risk and return. If investor decreases investment. It means, he is decreasing his risk of loss, at that time, his return will also decrease.

Examples of the Risk-Return Relationship

-

Government Bonds vs. Stocks:

Generally, government bonds are considered low-risk investments compared to stocks. Consequently, government bonds typically offer lower returns than stocks, which carry higher risk but also the potential for higher returns.

-

High-Yield (Junk) Bonds vs. Investment-Grade Bonds:

High-yield bonds offer higher interest rates than investment-grade bonds due to the higher credit risk associated with the issuing companies. Investors in high-yield bonds are compensated for accepting the increased risk of default.

- Negative Relationship between Risk and Return

The notion of a negative relationship between risk and return is contrary to the fundamental principles of finance, which typically assert a positive, direct relationship where higher risk is associated with higher expected returns. However, in specific contexts or interpretations, one might perceive scenarios or instances that seem to suggest a “negative” relationship, depending on how risk and return are defined or understood in those situations.

- Risk-Aversion and Capital Preservation:

For extremely risk-averse investors, the primary goal may be capital preservation rather than growth. In such cases, investors may opt for safer, low-risk investments like government bonds or high-quality fixed deposits, which offer lower returns but also significantly lower risk of loss. Here, the “negative relationship” is more about the investor’s preference for low risk over high return, rather than an inherent characteristic of the investments.

- Diminishing Marginal Returns to Risk:

In some investment strategies or during certain economic conditions, taking on additional risk does not proportionally increase expected returns. Beyond a certain point, the additional risk can lead to diminishing marginal returns. For instance, in a highly volatile market, aggressive investment strategies might lead to higher chances of loss, reducing the effective return on investment. Here, the perceived “negative relationship” is related to the efficiency of risk management rather than a fundamental principle.

- Mispriced Assets or Anomalies:

Market inefficiencies or mispriced assets may temporarily lead to situations where lower-risk investments outperform higher-risk ones. For example, defensive stocks (considered lower risk) might outperform the market during economic downturns, while more speculative stocks (higher risk) decline in value. These anomalies, often corrected over time, might suggest a “Negative relationship” between risk and return in the short term.

- Safe Haven Assets in Crisis Times:

During financial crises or periods of high market turmoil, investors often flock to safe-haven assets like gold or government bonds, which are perceived as lower risk. The increased demand for these assets can drive up their prices, leading to higher returns for these lower-risk investments in specific periods. Conversely, riskier assets like stocks may perform poorly. This flight to quality can create a temporary perception of a negative relationship between risk and return.

(A) High Risk–Low Return

Sometime, investor increases investment amount for getting high return but with increasing return, he faces low return because it is nature of that project. There is no benefit to increase investment in such project. Suppose, there are 1,00,000 lotteries in which you will earn the prize of You have bought 50% of total lotteries. But, if you buy 75% of lotteries. Prize will same but at increasing of risk, your return will decrease.

(B) Low Risk–High Return

There are some projects, if you invest low amount, you can earn high return. For example, Govt. of India need money. Because, govt. needs this money in emergency and Govt. is giving high return on small investment. If you get this opportunity and invest your money, you will get high return on your small risk of loss of money.

One thought on “Risk-Return Relationship”