Problems on preparation of Branch A/c in the books of Head Office under Cost Price Method and Invoice Price Method

29/03/2021Atif & Co. of Delhi consigned 100 units of goods, costing $100 per unit, to their agent Gupta & Co. in Mumbai at a proforma invoice of 20% on cost. Atif & Co. paid the following expenses:

- Loading charges: $100

- Freight: $200

- Insurance: $300

Gupta & Co. took delivery of goods and, on the same day, they sent a bank draft of $5,000 to Atif & Co. as advance against consignment.

Gupta & Co. forwarded an account sales revealing that 75 units were sold @ $140 per unit. Their expenses in respect of the consignment were as follows:

- Unloading charges: $75

- Carriage: $25

- Godown rent: $60

Gupta & Co. was allowed a commission of 10% on gross sale proceeds.

Required: Prepare journal eateries and draw up consignment account in the books of Atif & Co.

Solution

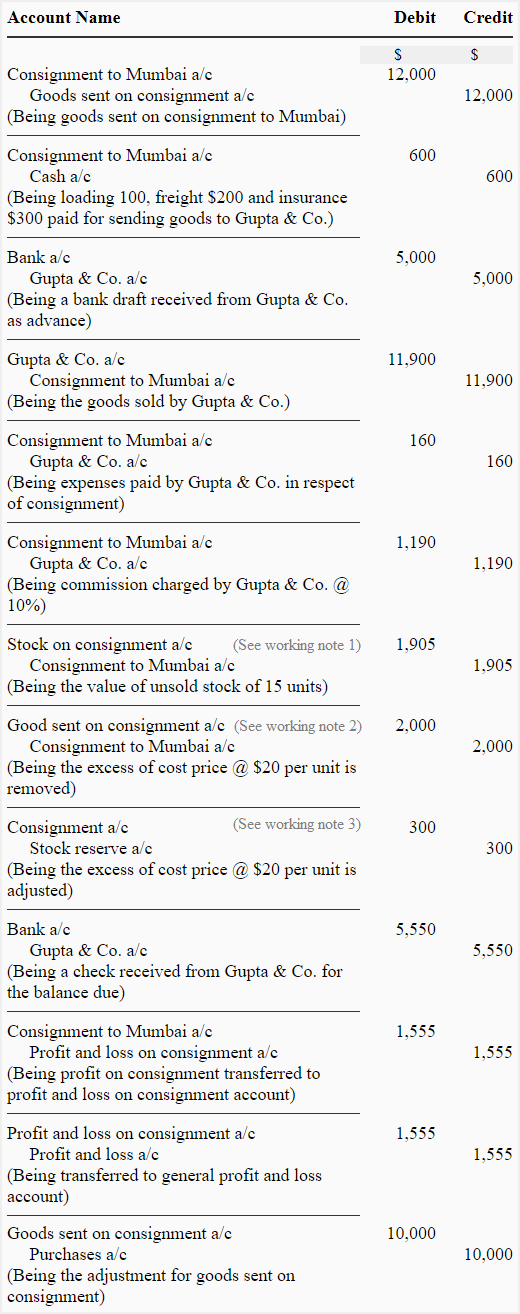

- Journal entries in the books of Atif & Co:

- Consignment to Mumbai account

Notice that the loading on goods sent on consignment has been credited and the loading on closing stock has been been debited to the Consignment to Mumbai Account. This action removes the excess price that was added to the original cost of goods and is necessary to calculate the correct profit on consignment.

Working note 1: Calculation of stock on consignment:

Working note 2: Calculation of excess price or loading on goods sent:

The goods were consigned at cost plus 20%. The cost of 100 units @ $100 is $10,000 and the excess price or loading can be computed as follows:

= ($12,000/120) × 20

= $2,000

or

100 units × $20

= $2,000

Working note 3: Calculation of excess price or loading on closing stock:

= (1,800/120) × 20

= $300

Or

15 units × $20

= $300