Explaining the causes of variances is a key step in variance analysis. In some cases the cause is purely operational (e.g. the price of raw materials went up due to market shortages) but in some cases the cause is due to poor budgeting and planning (e.g. we used an out of date price list when setting the standard cost of materials). Often causes are a mixture of planning and operating factors. Some firms seek to make these distinctions more explicit by separating out planning and operating variances.

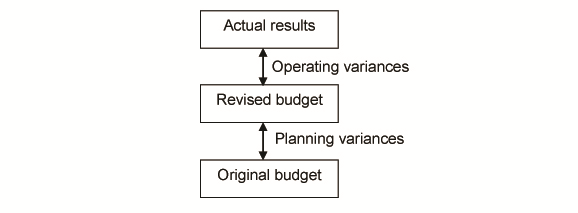

The basic approach is to have two budgets the original budget and a revised one that takes into account planning issues. We can then determine two sets of variances:

Planning and operational variances for sales

The sales volume variance can be sub-divided into a planning and operational variance:

Planning and operating variances for costs

When applying planning and operating principles to cost variances (material and labour), care must be taken over flexing the budgets. One accepted approach is to flex both the original and revised budgets to actual production levels:

Planning and operational analysis

The first step in the analysis is to calculate:

(1) Actual Results

(2) Revised flexed budget (ex-post)

(3) Original flexed budget (ex-ante)

When should a budget be revised?

There must be a good reason for deciding that the original standard cost is unrealistic. Deciding in retrospect that expected costs should be different from the standard should not be an arbitrary decision, aimed perhaps at shifting the blame for bad results due to poor operational management or poor cost estimation.

A good reason for a change in the standard might be:

- A change in one of the main materials used to make a product or provide a service

- An unexpected increase in the price of materials due to a rapid increase in world market prices (e.g. the price of oil or other commodities)

- A change in working methods and procedures that alters the expected direct labour time for a product or service

- An unexpected change in the rate of pay to the workforce.

These types of situations do not occur frequently. The need to report planning and operational variances should therefore be an occasional, rather than a regular, event.

If the budget is revised on a regular basis, the reasons for this should be investigated. It may be due to management attempting to shift the blame for poor results or due to a poor planning process.

Further thoughts on calculating planning and operating variances in accountancy exams

The basic idea given above is that

Key question: what is the revised budget volume?

There are three different ways of approaching planning and operating variances in accountancy exams.

Approach 1

If a revised volume is given (or can be easily calculated) then the best approach is to do two completely separate sets of variances.

This will result in the situation where the total traditional variance = planning + operating variances in total only but not line by line (e.g. materials price planning variance + materials price operating variance will not give the traditional materials price variance)

Approach 2

If no obvious revised volume is given (or can be calculated) then set revised budget volume = actual volume. This means that all cost variances are based on the actual output.

In this approach:

- No operating sales volume variance – its all planning

- Sales volume variance is thus effectively calculated on Original Standard Margin

- Planning cost variances will be based on actual output volumes

- Traditional variances = operating + planning variances on a line by line basis now rather than just in total

- Note that if the original budgeted volume is not given in the questions, then this approach must be used.

Approach 3

(Note: this approach seems to make more sense when only minor changes are made to the original budget – usually just a couple of prices. It is also the approach currently used for CIMA P1 and ACCA F5 exams.)

If no obvious revised volume is given (or can be calculated) then set revised budget volume = original budget volume.

In this approach:

- There is no planning sales volume variance – Its all operating

- Sales volume variance is thus effectively calculated on Revised Standard Margin

- Planning cost variances will be based on original budgeted volumes

- Total traditional variance = planning + operating in total only but not line by line

One thought on “Planning and Operational Variances”