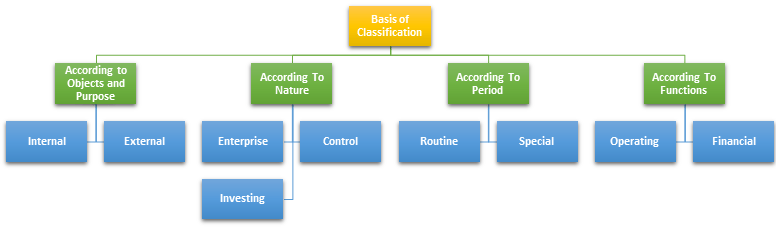

Kinds of Management Reports

27/07/2020-

Classification on the Basis of Object and Purpose:

(a) External Reports:

The reports prepared for external users or for the persons outside the business are known as external reports. External users may include shareholders, investors, creditors, suppliers and bankers. Though company may not be answerable to outsiders but still some reports are meant for outsiders.

The company publishes income statement and balance sheet at the end of every financial year and these statements are filed with the Registrar of companies and stock exchanges. Final statements of accounts are expected to conform to certain basic details in India Companies Act 1956 has made it obligatory to disclose some minimum information in final accounts. Following is an instance of Balance

(b) Internal Reports:

Internal reports refers to those reports which are meant for different level of management. Internal reports are not public documents and they are not expected to conform to any standards. These reports are prepared by keeping in view the needs of disposal for scanning them.

These reports may be meant for top level, middle level and lower level. The report meant for different levels of management may be regarded as internal reports. The frequency of these reports vary in accordance with purpose they serve.

Some of the internal reports that are commonly used are! Period report about profit and loss account and financial position, statement of cash flow, changes in working capital, report about cost of production, production trends and utilization of capacity.Labour turnover reports, material utilization reports, periodic reports on sales, credit collection periods and selling and distribution expenses, report on stock position etc.

2. Classification on the Basis of Nature:

According to nature, reports can be classified into three categories:

(a) Enterprise Reports:

These reports are prepared for the concern as a whole. These reports serve as a channel of communication with outsiders. Enterprise reports may concern all activities of the enterprise or may be related to different activities. Enterprise reports may include balance sheet, income statement, income tax returns, employment report, chairman’s report.

These reports contain standardized information and are beneficial to outsiders. The interpretation of financial statement can also be undertaken from these reports. The reports are important from financial analysis point of view. For instance following is chairman’s report presented by ShashiRuia Chairman of Essar Steel Ltd. reproduced for information:

Chairman’s Statement:

Dear Shareholder,

It is now well accepted by economic pundits and studies conducted across the globe that India and China will dominate the world economy in the 21st century. India is today the fourth largest economy in terms of purchasing power parity and is expected to overtake Japan and become third largest economic power after the United States of America and China, before the end of the decade. As India prepares to become an economic super power, it must further quicken the pace of reform and liaberalization by enabling the development of world class infrastructure, competitive manufacturing in scale and technology and sustainable development.

GDP growth of over 6.5% significant investments in infrastructure, a good agricultural output and a spurt in consumer demand across all sectors augurs for industry. If we are able to achieve a GDP growth of 8% annually, India will be the fastest growing free market democracy in the world.

Steel the backbone of Industry:

The steel industry is crucial to a nation’s economic competitiveness and security. Steel is integral to building of bridges, railroads, homes, automobiles, appliances and much more. Today’s steels are radically different than what was available ten years ago. They are lighter, higher in strength and more versatile.

The industry has undergone a major transformation in the last few years with companies investing in new process and product technologies, capacity enhancements and customer service initiatives. Indian steel companies are at the ‘leading edge’ of technology and spend considerable amounts on research and development.

The industry and particularly your company are able to compete internationally on technology, quality and price and have demonstrated that the India of tomorrow belongs to Indian entrepreneurs and Indian consumers. The Government needs to encourage and support the industry with a more realistic iron ore policy that creates level playing field.

Essar Steel- an eventful year:

Essar Steel’s excellent results demonstrate the company’s success in structurally improving its operating performance as a result of strategic actions and timely execution of projects. We have seen some signs of over-supply in international markets, but we do not see this as a long term issue. Your company is also much better prepared to manage cyclically in markets due to its geographic coverage and product portfolio.

Essar Steel is now a fully integrated producer with end-to-end control of all operations related to steel making. The acquisition of Hy-Grade Pellets Ltd. and Steel Corporation of Gujarat Ltd. make your company a totally integrated steel producer. The company has taken a number of initiatives in its manufacturing facilities to fulfill its mission of being one of the most cost efficient producers of steel globally.

From Bailadilla- where the iron ore beneficiation plant is located, close to the iron mines- to the final stage where the end products are dispatched to domestic and international destinations, your company has ensured that every stage of manufacture is seamlessly integrated. This will enable us to offer high quality, customized products for use by wide range of industries such as automobile and auto components, white goods, construction and consumer durables.

We focus on value addition at every stage of manufacture and also direct our efforts to high revenue generating markets. We do this by targeted marketing in specialized customer segments and technical and aftermarket support. We expect these value added products to contribute over 35% of the company’s revenues in the coming year.

Looking Ahead:

Currently we are producing at a capacity of 3 million tonnes and we have planned to augment this to 4.6 million tonnes by June 2006, making us the largest producer of flat steel in the private sector in India. This will involve an incremental investment ofRs 2000 crore, which is much below industry average and will considerably reduce our cost of production. We also plan to increase the pellet making capacity at Visakhapatnam from 4 to 8 million tonnes in this fiscal year.

The acquisitions, capacity expansions, technology upgradation and other productivity improvement measures will give you company a significant competitive edge in domestic and international markets. Our thrust on maintaining cost leadership through integrated manufacturing processes, research and new innovation and high productivity will provide a hedge against cyclically.

Managing Financial Turnaround:

Your company has been able to build a platform for consolidation and sustain the rejuvenation of its performance. In October 2002, at the time of the announcement of the CDR package, the Company had a term debt of? 5371 crore, which has been reduced to Rs 4262 crore as at March 31, 2005, a reduction of over Rs 1100 crore. The significant financial turnaround by the Company in such a short period of time is indeed noteworthy. With all other parameters of financial performance showing considerable improvement, your company is in a much stronger position to plan for more aggressive growth.

Our Driving Force:

Essar Steel is today at a significant point in its history. The past has given us learning’s that we have used to build a platform of security from the future. I must acknowledge the tremendous efforts put in by employees at all levels, who have to admirably risen to the challenges that change inevitably brings. Organizations must continuously change in order to survive and prosper. The Essar family has shown the capability and resilience to manage this change. We look to the future with confidence that arises out of our actions and the achievements of our people, as we prepare to face the “Brave New World”.

I also take this opportunity to thank our customers, vendors, business associates and bankers who have helped us come this far and look forward to their continued support in our journey to globalization.

Thank You.

ShashiRuia Chairman

(b) Control Reports:

Control reports deal with two aspects. One aspect relates to the personal performance and the other aspect deals with the economic performance. The first type of reports are prepared and reported to judge performance of managers and heads of various responsibility centres with what performance should have been under the prevailing circumstances.

The reasons for deviations in performance are also identified. The second type of reports shows how well the responsibility centre has fared as an economic activity. Such analysis is made periodically. This type of analysis requires the use of full cost accounting rather than responsibility accounting.

Control reports should consider the following:

(i) Control reports should be related to personal responsibility.

(ii) They should compare actual performance with the standards.

(iii) They should highlight significant information.

(iv) These reports should be sent at a proper time as to enable taking corrective measures.

(v) If possible various accounting ratios like, capacity, efficiency, activity and calendar ratios may be calculated.

(c) Investigating Reports:

These reports are linked with control reports. In case some serious problem arises then the causes of this situation are studied and analyzed, investigative reports are based on outcome of special solution studies. These reports are intermittent and are prepared only when a situation arises. They are prepared according to the nature of every situation. They are helpful to the management in analyzing the causes of some problem.

Example of Investigating Report:

The following information is available from monthly cost report of M/s Hard Engineering Co.:—

3. Classification on the Basis of Period:

According to the period repots can be classified as under:

(a) Routine Reports:

These reports are prepared about day to day working of the concern. They are periodically sent to various levels of management. These persons may differ according to the nature of information about details to be reported so far as the timing is concerned they may be sent daily, weekly, monthly or quarterly.

Routine reports may relate to sales information, production figures, capital expenditures, purchases of raw materials, market trends etc. There is a tendency to ignore routine reports by all recipients because of their routine nature. Important information in the report should be high-lighted or presented in a different way or may be written in a different ink.

Example of two routine reports are:

- Statement of Production

- Statement of Expenses

(b) Special Reports:

The management may confront some difficulties and routine report may not give sufficient information to tackle such situations. Under such circumstances, special reports are called for. Special reports are required for special purposes only.

These reports are prepared according to the need of situation. Available accounting information may not be sufficient, so data may have to be specially collected. There may be need to put extra staff for compiling these reports. It may also involve co-ordination of different departments and different levels of management. According to J. Batty33 special reports should be divided into sections each covering the following main purposes: 1. Reason for the report 2. Investigation made 3. Finding a conclusion and recommendations.

Special reports may deal with following topics:

(i) Information about market analysis and methods of distribution of competitors.

(ii) Technological changes in industry.

(iii) Problems about the purchase of materials.

(iv) Reports about change in methods of production and their implications.

(v) Trade association matters.

(vi) Report by secretary on company matters.

(vii) Political development at home and abroad having impact on business.

(ix) Report effect of idle capacity on cost of production.

(x) Make or buy decisions.

(xi) Report most suitable method of raising funds.

(xii) The effect of labour disputes on production and cost of production.

(xiii) Report on general economic forecast.

(xiv) Feasibility study for a project.

(xv) Report on effect of change in Government Policy.

4. Classification of Reports on the Basis of Functions:

According to function the reports may be divided into two categories:

(a) Operating Reports

(b) Financial Reports

(a) Operating Reports:

These reports provide information about operations of the concern.

The operating reports may consist of the following:

(i) Control Reports:

These reports are used for management control purposes. They are intended to spot deviations from budgeted performance without loss of time so that corrective action can be taken. Control reports are also used to assess the performance of individuals.

(ii) Information Reports:

These reports are prepared to provide useful information which will enable planning and policy formation for future. Information reports can take the form of trend reports and analytical reports. Trend reports provide information in comparative form over a period of time. Graphic presentation can be effectively used in trend reports. As opposed to trend reports, analytical reports provide information in a classified manner about composition of certain results so that one can identify specific factors in the overall total.

(b) Financial Reports:

These reports provide information about the financial position of the concern on specific dates or movement of finances during a specific period. The Balance Sheet provides information about a concern on a specific date. On the other hand Cash Flow Statement provides data about the movement of cash during a particular period. These reports can be either static or dynamic. Balance Sheet and other subsidiary reports are examples of static reports; Cash Flow, Fund Flow Statements and other reports showing financial position as compared to the budgeted are examples of dynamic reports.