The two components of working capital are current assets and current liabilities. The estimation of the amount of current assets and current liabilities to maintain a particular level of operation is not an easy task.

Inadequate working capital leads to disruption in the smooth production process while excess working capital increases the cost.

The estimation of working capital in case of trading and manufacturing concern is discussed here.

Manufacturing Concern:

The estimation of working capital for a manufacturing concern requires adoption of following steps:

(a) Determination of expected production per week or per month.

(b) Determination of cost for each element, i.e. Material, Labour and Overhead as well as Profit per unit.

(c) Calculation of amount blocked in each week/month for each element of Cost and Profit.

(d) Determination of operating cycle by estimating the Raw materials holding period. Processing time, finished goods storage period. Debt collection period. Creditor’s payment period. Time lag in payment of wages and overheads.

(e) Determination of Net block period. It is the period for which each element of cost remains blocked. For example, if Raw materials remain in stores for 2 weeks after purchase; Processing time is 2 weeks; Finished goods remain in stock for 3 weeks; Credit period extended to debtors is 4 weeks; and Payment for materials is made 2 weeks after purchase then, the Net block period will be:

[(2+ 2 + 3 + 4) – (2)] = 9 weeks.

(f) By multiplying Net block period as calculated in step (e) and the amount blocked for each element of cost as per step (c) we get the working capital requirement for each element of cost.

(g) By totalling all amounts as calculated for each element of cost and desired cash, if any, we get the total amount of working capital.

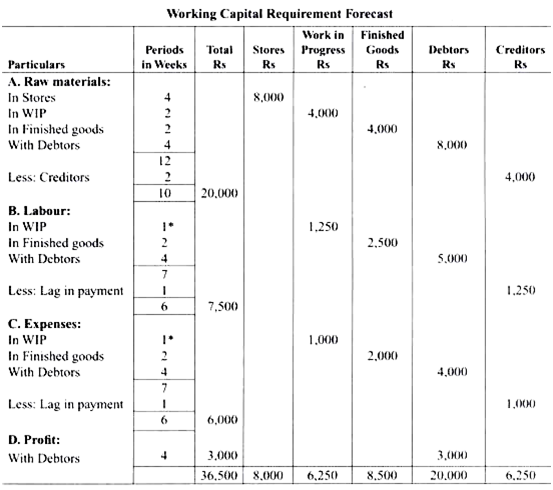

Example 7.1:

Determine the Working Capital requirement from the following information:

- Expected Sales 13,000 units

- Analysis of selling price:

Rs (per unit) |

|

Raw Materials |

8.00 |

Labour |

5.00 |

Expenses |

4.00 |

Profit |

3.00 |

Selling Price |

20.00 |

- Raw materials in store: 1 month

- Processing time: 2 weeks

- Finished product in store: 2 weeks

- Credit allowed to debtors: 4 weeks

- Credit allowed by creditors: 2 weeks

- Lag in payment for wages and expenses: 1 week

- Production is carried on evenly during the year and wages and expenses accrue in the same way.

Solution:

(a) Weekly Sales = 13,000/52 = 250 units

(b) Weekly Blockage:

Raw materials: 250 x Rs 8 = Rs 2,000

Labour: 250 x Rs 5 = Rs 1,250

Expenses: 250 x Rs 4 = Rs 1,000

Profit: 250 x Rs 3 = Rs 750

One thought on “Estimation of requirements in case of Trading & Manufacturing Organizations”