This system suggests that any supply chain can be measured on three key dimensions.

A) Service

B) Assets

C) Speed

Service relates to the ability to anticipate, capture and fulfill customer demand with personalized products and on-time delivery; Assets involve anything with commercial value, primarily inventory and cash; and Speed includes metrics which are time related, they track responsiveness and velocity of execution.

Every supply chain should have at least one performance measure on each of these three critical dimensions.

A) Service Metrics

The basic premise for service metrics is to measure how well the company is serving (or not serving) its customers. Generally it is difficult to quantify the cost of stock outs or late deliveries, so the targets are set on customer service metrics. Also, the build-to stock situation differs from the build-to-order situation, so related but different metrics are used in these environments. Table 13.3 contains some common service metrics used in these two environments. These are time-tested measures, which continue to be valuable customer service metrics for supply chains.

The Line Item Fill Rate is the percentage of individual “lines” on all customer orders, which are filled immediately, while the Order Fill Rate counts as a success only those customer orders in which all “lines” have been filled.

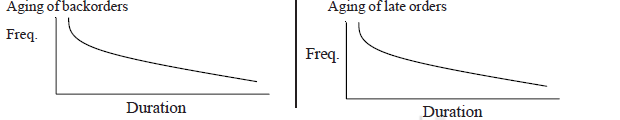

“Aging” refers to maintaining data on how long it takes to fill a backorder, or how long it takes to complete an order, which is late. Tracking this data and maintaining it in an accessible database enables its periodic recall.

| Build to Stock (BTS) | Build to Order (BTO) |

| Line item fill Rate | Quoted customer Response Time |

| Complete order fill Rate | On-time Completion |

| Delivery process on Time | Delivery process on Time |

| Backordered/Lost Sales | Late orders |

| No of Order | No. of Late Orders |

In the IT and especially Internet era, extensions of the customer order response time include the on-line service response time of a website as well as the response time required to complete delivery of the product or service.

B) Assets Metrics

The major asset involved in supply chains is inventory throughout the chain. Two metrics generally used for inventory are:

1) Monetary Value ($, Yen, Euro, et cetera)

2) Time Supply or Inventory Turns

Inventory can be measured as a time supply, for example a 3-week supply of inventory, or as inventory turns, defined as

Turns = (Cost of goods sold)/(Inventory Value)

The Time Supply or Turns measures relate to inventory flows; the Value of inventory relates to inventory as an asset on the firm’s Balance Sheet. Inventory Turns are calculated in isolation, by accountants with access to financial and inventory data but without corresponding access to customer service data.

C) Speed Metrics

There are a series of metrics related to timeliness, speed, responsiveness and flexibility

- Cycle (flow) Time at a Node

- Supply Chain Cycle Time

- Cash Conversion Cycle

- “Upside” Flexibility

Cycle Time Reduction- i.e. lowering lead-time and WIP inventory levels.

The Supply Chain Cycle Time – measures the total time it would take to fulfill a new order if all upstream and in-house inventory levels were zero. It is measured by adding up the longest (bottleneck) lead times at each stage in the supply chain.

The Cash Conversion Cycle (or Cash to Cash cycle time) attempts to measure the time elapsed between paying the suppliers for material and getting paid by the customers. It is estimated as follows, with all quantities measured in days of supply:

Cash Conversion Cycle = Inventory + Accounts Receivable – Accounts Payable

Upside flexibility refers to requirements in high-tech industry that a vendor be prepared to provide say 25% additional material above and beyond the committed order, in order for the buyer to be protected when the buyer’s demand is higher than forecasted.

Dimension based measurement system tries to cover the different dimension of the supply chain and also provide the detailed measure for each dimension. The system has limitation to provide the strategic alignment of different dimension and to measure the effect of different tradeoff between the dimensions.

Interface Based Measurement System

This framework aligns performance at each link (supplier customer pair) within the supply chain. The framework begins with the linkages at the focal company and moves outward a link at a time. The link-by-link approach provides a means for aligning performance from point-of-origin to point-of-consumption with the overall objective of maximizing shareholder value for the total supply chain as well as for each company.

The framework consists of seven steps:

- Map the supply chain from point-of-origin to point-of-consumption to identify where key linkages exist.

- Use the customer relationship management and supplier relationship management processes to analyze each link (customer supplier pair) and determine where additional value can be created for the supply chain.

- Develop customer and supplier profit and loss (P&L) statements to assess the effect of the relationship on profitability and shareholder value of the two firms.

- Realign supply chain processes and activities to achieve performance objectives.

- Establish non-financial performance measures that align individual behavior with supply chain process objectives and financial goals.

- Compare shareholder value and market capitalization across firms with supply chain objectives and revise process and performance measures as necessary.

- Replicate steps at each link in the supply chain.

Interface based measurement system looks at the supply chain as a series of different links and to optimize the total supply chain a win-win approach is required at all linkages. Conceptually it looks good but in actual business setting it requires openness and total sharing of information at every link of the chain, which seem to be difficult to implement.

Comparison of measurement systems

Different measurement systems described above have different views for integrating the supply chain performance measures. These systems can be compared using five dimensions:

(1) Hierarchy (Strategic, Tactical and Operational)

(2) Results (Financial and Non-financial)

(3) Linkages (Integrated and Isolated)

(4) Determinants (Quality, Flexibility and Time)

(5) Stability (Static and Dynamic).

It is evident from the above explanations that supply chain balanced scorecard covers all the parameters.

The system is easy to implement if the company strategy is well defined. Hierarchical based measurement system encompasses all parameters but at one time it tries to cover only one perspective, so a hybrid model of balance score card and hierarchical can be an another alternative i.e. at each hierarchical level we define the measure for each perspective.

Perspective based system also sees the measures in isolated manner but it covers some unique perspectives which are not covered in balance scorecard like system dynamics and operation research which provides a great help in measuring dynamic capability of supply chain. SCOR covers all relevant parameters required in the system and tries to cover the whole supply chain in standard set of processes.

It also covers the different dimensions at each level of the supply chain. The model applicability is easier where ERP and BPR practices are in progress and large set of data collection software’s are already in place. In SMEs and especially in Indian context applicability is questionable due to extra cost of maintaining such an exhaustive system. Interface based measurement system doesn’t cover the non-financial measures and strategic links to different linkages is not possible. The system gives more emphasis on strengthening the internal and external linkage to improve the overall supply chain.

Selecting measures

While the approaches described above provide guidance for supply chain measurement, they provide less help in assessing specific metrics to be used. In this regard, a key driving principle is that measures should be aligned to strategic objectives. Supply chain strategy depends upon its current competencies and strategic direction, which differs for every company. Companies, for example, can generally fall into the following developmental stages that will dictate the types of measures and the degrees to which they will need to focus:

- Functional Excellence: A stage in which a company needs to develop excellence within each of its operating units such as the manufacturing, customer service, or logistics departments. Metrics for a company in this stage will need to focus on individual functional departments.

- Enterprise-Wide Integration: A stage in which a company needs to develop excellence in its cross-functional processes rather than within its individual functional departments. Metrics for a company in this stage will need to focus on cross-functional processes.

- Extended Enterprise Integration: A stage in which a company needs to develop excellence in inter-enterprise processes. Metrics for a company in this stage will focus on external and cross-enterprise metrics.

Most companies have focused their performance measurement on achieving functional excellence. With the advent of Supply Chain Management (SCM) principles aimed at integrating their supply chains, many have objectives to increase their degree of enterprise-wide integration and extended enterprise integration. In order to achieve these types of objectives, their performance measurement systems will need to align to them.

One thought on “Dimensions of Performance Measurement in Supply Chain”