Canons of taxation refer to the administrative aspects of a tax. They relate to the rate, amount, method of levy and collection of a tax.

In other words, the characteristics or qualities which a good tax should possess are described as canons of taxation. It must be noted that canons refer to the qualities of an isolated tax and not to the tax system as a whole. A good tax system should have a proper combination of all kinds of taxes having different canons.

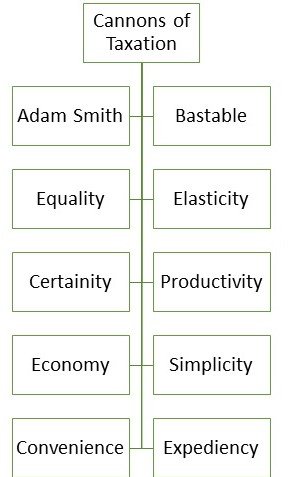

According to Adam Smith, there are four canons or maxims of taxation on the administrative side of public finance which are still recognised as classic.

To him a good tax is one which contains:

- Canon of equality or equity.

- Canon of certainty.

- Canon of economy.

- Canon of convenience.

To these four canons, economists like Bastable have added a few more which are as under:

- Canon of elasticity.

- Canon of productivity.

- Canon of simplicity.

- Canon of diversity.

- Canon of expediency

Chart represent the different canons of taxation.

Every fiscal economist, along with Adam Smith, stresses that taxation must ensure justice. The canon of equality or equity implies that the burden of taxation must be distributed equally or equitably in relation to the ability of the tax payers.

Equity or social justice demands that the rich people should bear a heavier burden of tax and the poor a lesser burden. Hence, a tax system should contain progressive tax rates based on the tax-payer’s ability to pay and sacrifice.

Canon of Certainty:

Taxation must have an element of certainty. According to Adam Smith, “the tax which each individual is bound to pay ought to be certain and not arbitrary. The time of payment, the manner of payment, the amount to be paid ought to be clear and plain to the contributor and to every other person.”

The certainty aspects of taxation are:

- Certainty of effective incidence i.e., who shall bear the tax burden.

- Certainty of liability as to how much shall be the tax amount payable in a particular period. This the tax payers as well as the exchequer should unambiguously know.

- Certainty of revenue i.e., the government should be certain about the estimated collection of revenue from a given tax levied.

2 thoughts on “Cannons of Taxation”