Valuation of Options

25/08/2020The value of an option can be estimated using a variety of quantitative techniques based on the concept of risk neutral pricing and using stochastic calculus. In general, standard option valuation models depend on the following factors:

- The current market price of the underlying security

- The strike price of the option, particularly in relation to the current market price of the underlying asset (in the money vs. out of the money)

- The cost of holding a position in the underlying security, including interest and dividends

- The time to expiration together with any restrictions on when exercise may occur, and

- An estimate of the future volatility of the underlying security’s price over the life of the option.

The Valuation of Options

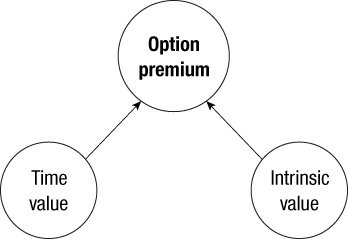

As we said before, options themselves have a value. Remember that options are totally separate entities to the underlying assets from which they are derived (hence, the term derivative). But in themselves they do have a value, which can be split into two parts: intrinsic value and time value.

In general:

- Intrinsic value is that part of the option’s value that is in-the-money (ITM).

- Time value is the remainder of the option’s value. Out-of-the-money (OTM) options will have no intrinsic value, and their price will solely be based on time value. Time value is another way of saying hope value. This hope is based on the amount of time left until expiration and the price of the underlying asset.

- A call is ITM when the underlying asset price is greater than the strike price.

- A call is OTM when the underlying asset price is less than the strike price.

- A call is at-the-money (ATM) when the underlying asset price is the same as the strike price.

Put options work the opposite way:

- A put is ITM when the underlying asset price is less than the strike price.

- A put is OTM when the underlying asset price is greater than the strike price.

- A put is ATM when the underlying asset price is the same as the strike price.

Trade Options

The main reason for trading options is that for a smaller amount of money you can control a large amount of stock, particularly with call options. Call options are always cheaper than the underlying asset and put options usually are. Options are generally more volatile than their underlying instruments; therefore, investors get “more bang for their buck” or more action. Clearly this can lead to danger, but as you’ll see, it also can lead to more safety and security. You’ll also see that it can mean much greater flexibility in your trading and even give you the ability to make profit when you don’t know the direction in which the stock will move.

Options are generally more volatile than their underlying instruments; therefore, investors get “more bang for their buck” or more action.

Those investors with portfolios can set up protective measures in the event of a market downturn. It is also quite possible to set up a position whereby you can only make profit. Perhaps not a hugely exciting profit in triple digits, but a certain profit nevertheless. Options make this type of scenario possible.

In short, options give the investor added flexibility, potentially much greater gains for a given movement in the stock price, and protection against risk. On the flip side, used in the wrong way, options can lead people to serious losses. You will be learning safe strategies only and the simple rules governing those types of trade.