Financial forecasting is the processing, estimating, or predicting how a business will perform in the future. The most common type of financial forecast is an income statement, however, in a complete financial model, all three statements are forecasted. In this guide on how to build a financial forecast, we will complete the income statement model from revenue to operating profit or EBIT.

Financial forecasting is concerned with the projection of future financial performance, condition, flows, and requirements.

It enables the firm to protest the financial feasibility of various policies and actions, it facilitates the raising of funds by enhancing the confidence of lenders in the management of the firm, it provides a basis of control and improves the utilization of resources.

Major Components of Financial Forecasting

-

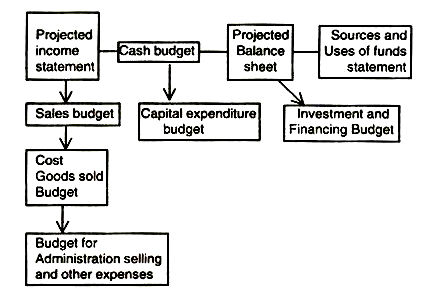

Projected Income statement

The projected income statement also referred to as the profit plan or operating budget, shows the expected revenues and expenses for the budget period, usually, one year, and the net financial results of the operations.

The profit plan of the firm is based on several budgets, Sales budget, production budget, materials and purchases budget, labour cost budget, manufacturing overhead budget, and budget for non-manufacturing costs.

-

Cash budget

The cash budget reflects the cash inflows and outflows expected In the future. The major sources of cash Inflow are: Cash sales, collection of accounts receivable, disposal of assets, short-term borrowing, long-term debt and equity capital.

The important cash outflows relate to: Cash purchases, payment of accounts payable, wages, salaries, rent, interest, taxes, dividends, capital expenditures and repayment of loans and debentures. The cash budget should not include noncash expense items like depreciation.

The projected surpluses/deficits in the cash budget provide the basis for investment (where there is a surplus beyond the target cash balance the firm wishes to maintain) and financing (when the projected cash balance falls below the target cash balance).

-

Projected Balance Sheet

The projected balance sheet shows the projected assets, liabilities and owners equity at the end of the period. The inputs required for its preparation are the initial balance sheet, the profit plan, the capital expenditure budget, the cash budget, and the investment and financing plan.

-

Projected sources and uses of funds statement

The projected sources and uses of funds statement shows the sources of funds and uses of funds in the planning period (funds are usually defined as working capital). The inputs required for its preparation are the initial balance sheet, the projected balance sheet and the projected income statement.

The projected sources of funds are:

- Operations (profit before tax plus depreciation),

- Issue of additional share capital

- Decrease in fixed assets, and

- Increase in long-term liabilities

The projected uses of funds are:

- Tax payment,

- Dividend payment

- Decrease in long-term liabilities

- Gross increase in fixed assets, and

- Net change in working capital

Methods of Financial Forecasting

-

Qualitative Techniques of Financial Forecasting

(i) Executive Opinions

In this method, the expert opinions of key personnel of various departments, such as production, sales, purchasing and operations, are gathered to arrive at future predictions. The management team makes revisions in the resulting forecast, based on their expectations.

(ii) Reference Class Forecasting

This method involves predicting the outcome of a planned action based on similar scenarios in other times or places. This is used to defy predictions that are arrived at based only on human judgment.

(iii) Delphi Technique

Here, a series of questionnaires are prepared and answered by a group of experts, who are kept separate from each other. Once the results of the first questionnaire are compiled, a second questionnaire is prepared based on the results of the first. This second document is again presented to the experts, who are then asked to reevaluate their responses to the first questionnaire. This process continues until the researchers have a narrow shortlist of opinions.

(iv) Sales Force Polling

Some companies believe that salespersons have close contact with the consumers and could provide significant insights regarding customer behavior. In this method of forecasting, the estimates are derived based on the average of sales force polling.

(v) Consumer Surveys

Businesses often conduct market surveys of consumers. The data is collected via telephonic conversations, personal interviews or survey questionnaires, and extensive statistical analysis is conducted to generate forecasts.

(vi) Scenario Writing

In this method, the forecaster generates different outcomes based on diverse starting criteria. The management team decides on the most likely outcome from the numerous scenarios presented.

-

Quantitative Techniques of Financial Forecasting

(i) Proforma Financial Statements

Proforma statements use sales figures and costs from the previous two to three years after excluding certain one-time costs. This method is mainly used in mergers and acquisitions, as well as in cases where a new company is forming and statements are needed to request capital from investors.

(ii) Time-Series Forecasting

Time-series forecasting is a popular quantitative forecasting technique, in which data is gathered over a period of time to identify trends. Time-series methods are one of the simplest methods to deploy and can be quite accurate, particularly over the short term. Some techniques that fall within this method are simple averaging and exponential smoothing.

(iii) Cause-Effect Method

Here, the forecaster examines the cause-and-effect relationships of the variable with other relevant variables such as changes in consumers’ disposable incomes, the interest rate, the level of consumer confidence, and unemployment levels. This method uses past time series on many relevant variables to produce the forecast for the variable of interest.

Financial forecasting is tough and selection of the appropriate forecasting method is crucial to achieve the desired results. One needs to remember that the chosen method for one program may differ for another. While complex techniques may give accurate predictions in special cases, simpler techniques tend to perform just as well. Whatever may be the case, financial forecasting always helps to predict future performance and aids decision makers.