Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value. Businesses depreciate long-term assets for both tax and accounting purposes. For tax purposes, businesses can deduct the cost of the tangible assets they purchase as business expenses; however, businesses must depreciate these assets according to IRS rules about how and when the company can take the deduction.

Depreciation is often a difficult concept for accounting students as it does not represent real cash flow. Depreciation is an accounting convention that allows a company to write off an asset’s value over time, but it is considered a non-cash transaction.

Depreciation Example

For accounting purposes, depreciation expense does not represent a cash transaction, but it shows how much of an asset’s value the business has used over a period. For example, if a company buys a piece of equipment for $50,000, it can either write the entire cost of the asset off in year one or write the value of the asset off over the assets 10-year life. This is why business owners like depreciation. Most business owners prefer to expense only a portion of the cost, which artificially boosts net income. In addition, the company can scrap the equipment for $10,000, which means it has a salvage value of $10,000. Using these variables, the analyst calculates depreciation expense as the difference between the cost of the asset and the salvage value, divided by the useful life of the asset. The calculation in this example is ($50,000 – $10,000) / 10, which is $4,000.

This means the company’s accountant does not have to write off the entire $50,000, even though it paid out that amount in cash. Instead, the company only has to expense $4,000 against net income. The company expenses another $4,000 next year and another $4,000 the year after that, and so on, until the company writes off the value of the equipment in year 10.

Causes of Depreciation

Depreciation is a ratable reduction in the carrying amount of a fixed asset. Depreciation is intended to roughly reflect the actual consumption of the underlying asset, so that the carrying amount of the asset has been greatly reduced to its salvage value by the time its useful life is over. But why do we need depreciation at all? The causes of depreciation are:

(i) Wear and Tear

Any asset will gradually break down over a certain usage period, as parts wear out and need to be replaced. Eventually, the asset can no longer be repaired, and must be disposed of. This cause is most common for production equipment, which typically has a manufacturer’s recommended life span that is based on a certain number of units produced. Other assets, such as buildings, can be repaired and upgraded for long periods of time.

(ii) Perishability

Some assets have an extremely short life span. This condition is most applicable to inventory, rather than fixed assets.

(iii) Usage rights

A fixed asset may actually be a right to use something (such as software or a database) for a certain period of time. If so, its life span terminates when the usage rights expire, so depreciation must be completed by the end of the usage period.

(iv) Natural resource usage

If an asset is natural resources, such as an oil or gas reservoir, the depletion of the resource causes depreciation (in this case, it is called depletion, rather than depreciation). The pace of depletion may change if a company subsequently alters its estimate of reserves remaining.

(v) Inefficiency/obsolescence

Some equipment will be rendered obsolete by more efficient equipment, which reduces the usability of the original equipment.

A variation on the depreciation concept is the destruction of or damage to equipment. If this happens, the equipment must be written down or written off to reflect its reduced value and possibly shorter useful life. Another variation is asset impairment, where the carrying cost of an asset is higher than its market value. If impairment occurs, the difference is charged to expense, which reduces the carrying amount of the asset.

When there is damage to or impairment of an asset, it can be considered a cause of depreciation, since either event changes the amount of depreciation remaining to be recognized.

Inputs to Depreciation Accounting

There are three factors to consider when you calculate depreciation, which are:

- Useful life. This is the time period over which the company expects that the asset will be productive. Past its useful life, it is no longer cost-effective to continue operating the asset, so it is expected that the company will dispose of it. Depreciation is recognized over the useful life of an asset.

- Salvage value. When a company eventually disposes of an asset, it may be able to sell it for some reduced amount, which is the salvage value. Depreciation is calculated based on the asset cost, less any estimated salvage value. If salvage value is expected to be quite small, then it is generally ignored for the purpose of calculating depreciation.

- Depreciation method. You can calculate depreciation expense using an accelerated depreciation method, or evenly over the useful life of the asset. The advantage of using an accelerated method is that you can recognize more depreciation early in the life of a fixed asset, which defers some income tax expense recognition into a later period. The advantage of using a steady depreciation rate is the ease of calculation. Examples of accelerated depreciation methods are the double declining balance and sum-of-the-years digits methods. The primary method for steady depreciation is the straight-line method. The units of production method is also available if you want to depreciate an asset based on its actual usage level, as is commonly done with airplane engines that have specific life spans tied to their usage levels.

If, midway through the useful life of an asset, you expect its useful life or the salvage value to change, you should incorporate the alteration into the calculation of depreciation over the remaining life of the asset; do not retrospectively change any depreciation that has already been recorded.

Depreciation Journal Entries

When you record depreciation, it is a debit to the Depreciation Expense account and a credit to the Accumulated Depreciation account. The Accumulated Depreciation account is a contra account, which means that it appears on the balance sheet as a deduction from the original purchase price of an asset.

Once you dispose of an asset, you credit the Fixed Asset account in which the asset was originally recorded, and debit the Accumulated Depreciation account, thereby flushing the asset out of the balance sheet. If an asset was not fully depreciated at the time of its disposal, it will also be necessary to record a loss on the undepreciated portion. This loss will be reduced by any proceeds from sale of the asset.

Other Depreciation Issues

Depreciation has nothing to do with the market value of a fixed asset, which may vary considerably from the net cost of the asset at any given time.

Depreciation is a major issue in the calculation of a company’s cash flows, because it is included in the calculation of net income, but does not involve any cash flow. Thus, a cash flow analysis calls for the inclusion of net income, with an add-back for any depreciation recognized as expense during the period.

Depreciation is not applied to intangible assets. Instead, amortization is used to reduce the carrying amount of these assets. Amortization is almost always calculated using the straight-line method.

Straight Line Method (SLM)

According to the Straight line method, the cost of the asset is written off equally during its useful life. Therefore, an equal amount of depreciation is charged every year throughout the useful life of an asset. After the useful life of the asset, its value becomes nil or equal to its residual value. Thus, this method is also called Fixed Installment Method or Fixed percentage on original cost method.

When the amount of depreciation and the corresponding period are plotted on a graph it results in a straight line. Hence, it is known as the Straight line method (SLM).

This method is more suitable in case of leases and where the useful life and the residual value of the asset can be calculated accurately. However, where the repairs are low in the initial years and increase in subsequent years, this method will increase the charge on profit.

Also, while applying this method, the period of use of the asset should be considered. If an asset is used only for 3 months in a year then depreciation will be charged only for 3 months. However, for the Income Tax purposes, if an asset is used for more than 180 days full years’ depreciation will be charged.

Formulae:

Amount of Depreciation = (Cost of Asset – Net Residual Value) / Useful Life

The rate of Depreciation = (Annual Depreciation x 100) / Cost of Asset

Diminishing Balance Method

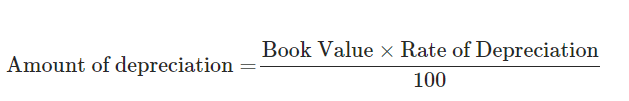

According to the Diminishing Balance Method, depreciation is charged at a fixed percentage on the book value of the asset. As the book value reduces every year, it is also known as the Reducing Balance Method or Written-down Value Method.

Since the book value reduces every year, hence the amount of depreciation also reduces every year. Under this method, the value of the asset never reduces to zero.

When the amount of depreciation charged under this method and the corresponding period are plotted on a graph it results in a line moving downwards.

This method is based on the assumption that in the earlier years the cost of repairs to the assets is low and hence more amount of depreciation should be charged. Also, in the later years, the cost of repairs will increase and therefore less amount of depreciation shall be provided. Hence, this method results in an equal burden on the profit every year during the life of the asset.

However, under this method, if the rate of depreciation applied is not appropriate it may happen that at the end of the useful life of the asset full depreciation is not provided.

Also, while applying this method, the period of use of the asset should be considered. If an asset is used only for 2 months in a year then depreciation will be charged only for 2 months.

One thought on “Depreciation in an Accounting”