Balance Sheet

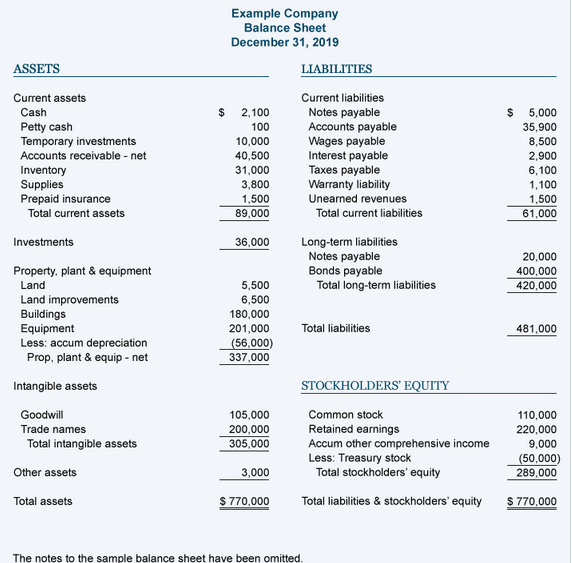

15/04/2020The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity. It can also be referred to as a statement of net worth, or a statement of financial position. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity.

Total Assets = Current Assets+ Non-current Assets |

Total Liabilities = Current Liabilities + Non-current Liabilities |

Total Shareholders’ equity = Share capital + Retained earning |

As such, the balance sheet is divided into two sides (or sections). The left side of the balance sheet outlines all of a company’s assets. On the right side, the balance sheet outlines the companies liabilities and shareholders’ equity. On either side, the main line items are generally classified by liquidity. More liquid accounts such as Inventory, Cash, and Trades Payables are placed before illiquid accounts such as Plant, Property, and Equipment (PP&E) and Long-Term Debt. The assets and liabilities are also separated into two categories: current asset/liabilities and non-current (long-term) assets/liabilities.

Assets

Assets are things that the company owns. They are the resources of the company that have been acquired through transactions, and have future economic value that can be measured and expressed in dollars. Assets also include costs paid in advance that have not yet expired, such as prepaid advertising, prepaid insurance, prepaid legal fees, and prepaid rent. (For a discussion of prepaid expenses go to Explanation of Adjusting Entries.)

Examples of asset accounts that are reported on a company’s balance sheet include:

- Cash

- Petty Cash

- Temporary Investments

- Accounts Receivable

- Inventory

- Supplies

- Prepaid Insurance

- Land

- Land Improvements

- Buildings

- Equipment

- Goodwill

Usually asset accounts will have debit balances.

Contra assets are asset accounts with credit balances. (A credit balance in an asset account is contrary or contra to an asset account’s usual debit balance.) Examples of contra asset accounts include:

- Allowance for Doubtful Accounts

- Accumulated Depreciation-Land Improvements

- Accumulated Depreciation-Buildings

- Accumulated Depreciation-Equipment

- Accumulated Depletion

[…] VIEW […]

[…] VIEW […]

[…] VIEW […]