Debt investments and equity investments recorded using the cost method are classified as trading securities, available‐for‐sale securities, or, in the case of debt investments, held‐to‐maturity securities. The classification is based on the intent of the company as to the length of time it will hold each investment. A debt investment classified as held‐to‐maturity means the business has the intent and ability to hold the bond until it matures. The balance sheet classification of these investments as short‐term (current) or long‐term is based on their maturity dates.

Debt and equity investments classified as trading securities are those which were bought for the purpose of selling them within a short time of their purchase. These investments are considered short‐term assets and are revalued at each balance sheet date to their current fair market value. Any gains or losses due to changes in fair market value during the period are reported as gains or losses on the income statement because, by definition, a trading security will be sold in the near future at its market value. In recording the gains and losses on trading securities, a valuation account is used to hold the adjustment for the gains and losses so when each investment is sold, the actual gain or loss can be determined. The valuation account is used to adjust the value in the trading securities account reported on the balance sheet.

Debt and equity investments that are not classified as trading securities or held‐to‐maturity securities are called available‐for‐sale securities. Whereas trading securities are short‐term, available‐for‐sale securities may be classified as either short‐term or long‐term assets based on management’s intention of when to sell the securities. Available‐for‐sale securities are also valued at fair market value. Any resulting gain or loss is recorded to an unrealized gain and loss account that is reported as a separate line item in the stockholders’ equity section of the balance sheet. The gains and losses for available‐for‐sale securities are not reported on the income statement until the securities are sold. Unlike trading securities that will be sold in the near future, there is a longer time before available‐for‐sale securities will be sold, and therefore, greater potential exists for changes in the fair market value.

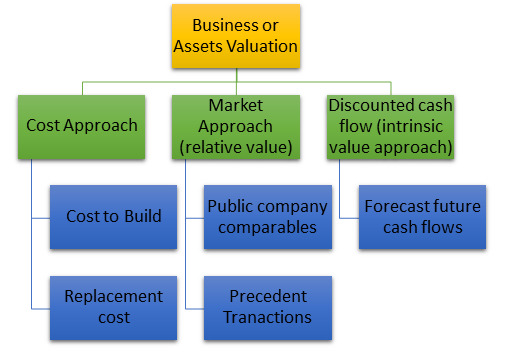

When valuing a company as a going concern, there are three main valuation methods used by industry practitioners:

(1) DCF analysis

(2) comparable company analysis,

(3) precedent transactions.

These are the most common methods of valuation used in investment banking, equity research, private equity, corporate development, mergers & acquisitions (M&A), leveraged buyouts (LBO), and most areas of finance.

As shown in the diagram above, when valuing a business or asset, there are three broad categories that each contain their own methods. The Cost Approach looks at what it costs to build something and this method is not frequently used by finance professionals to value a company as a going concern. Next is the Market Approach, this is a form of relative valuation and frequently used in the industry. It includes Comparable Analysis Precedent Transactions. Finally, the discounted cash flow (DCF) approach is a form of intrinsic valuation and is the most detailed and thorough approach to valuation modeling.

Method 1: Comparable Analysis (“Comps”)

Comparable company analysis (also called “trading multiples” or “peer group analysis” or “equity comps” or “public market multiples”) is a relative valuation method in which you compare the current value of a business to other similar businesses by looking at trading multiples like P/E, EV/EBITDA, or other ratios. Multiples of EBITDA are the most common valuation method.

The “comps” valuation method provides an observable value for the business, based on what companies are currently worth. Comps are the most widely used approach, as they are easy to calculate and always current.

Method 2: Precedent Transactions

Precedent transactions analysis is another form of relative valuation where you compare the company in question to other businesses that have recently been sold or acquired in the same industry. These transaction values include the take-over premium included in the price for which they were acquired.

These values represent the en bloc value of a business. They are useful for M&A transactions, but can easily become stale-dated and no longer reflective of the current market as time passes. They are less commonly used than Comps or market trading multiples.

Method 3: DCF Analysis

Discounted Cash Flow (DCF) analysis is an intrinsic value approach where an analyst forecasts the business’ unlevered free cash flow into the future and discounts it back to today at the firm’s Weighted Average Cost of Captial (WACC).

A DCF analysis is performed by building a financial model in Excel and requires an extensive amount of detail and analysis. It is the most detailed of the three approaches, requires the most assumptions, and often produces the highest value. However, the effort required for preparing a DCF model will also often result in the most accurate valuation. A DCF model allows the analyst to forecast value based on different scenarios, and even perform a sensitivity analysis.

For larger businesses, the DCF value is commonly a sum-of-the-parts analysis, where different business units are modeled individually and added together.