A company, being an artificial person, cannot generate its own capital which has necessarily to be collected from several persons. These persons are known as shareholders and the amount contributed by them is called share capital.

Since the number of shareholders is very large, a separate capital account cannot be opened for each one of them. Hence, innumerable streams of capital contribution merge their identities in a common capital account called as ‘Share Capital Account’.

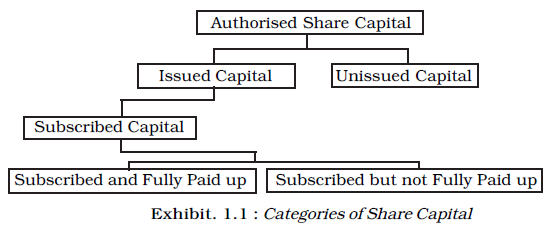

Categories of Share Capital

From accounting point of view the share capital of the company can be classified as follows:

Authorised Capital: Authorised capital is the amount of share capital which a company is authorised to issue by its Memorandum of Association. The company cannot raise more than the amount of capital as specified in the Memorandum of Association. It is also called Nominal or Registered capital. The authorised capital can be increased or decreased as per the procedure laid down in the Companies Act. It should be noted that the company need not issue the entire authorised capital for public subscription at a time. Depending upon its requirement, it may issue share capital but in any case, it should not be more than the amount of authorised capital.

- Issued Capital: It is that part of the authorised capital which is actually issued to the public for subscription including the shares allotted to vendors and the signatories to the company’s memorandum. The authorised capital which is not offered for public subscription is known as ‘unissued capital’. Unissued capital may be offered for public subscription at a later date.

- Subscribed Capital: It is that part of the issued capital which has been actually subscribed by the public. When the shares offered for public subscription are subscribed fully by the public the issued capital and subscribed capital would be the same. It may be noted that ultimately, the subscribed capital and issued capital are the same because if the number of share, subscribed is less than what is offered, the company allot only the number of shares for which subscription has been received. In case it is higher than what is offered, the allotment will be equal to the offer. In other words, the fact of over subscription is not reflected in the books.

- Called up Capital: It is that part of the subscribed capital which has been called up on the shares. The company may decide to call the entire amount or part of the face value of the shares. For example, if the face value (also called nominal value) of a share allotted is Rs. 10 and the company has called up only Rs. 7 per share, in that scenario, the called up capital is Rs. 7 per share. The remaining Rs. 3 may be collected from its shareholders as and when needed.

- Paid up Capital: It is that portion of the called up capital which has been actually received from the shareholders. When the shareholders have paid all the call amount, the called up capital is the same to the paid up capital. If any of the shareholders has not paid amount on calls, such an amount may be called as ‘calls in arrears’. Therefore, paid up capital is equal to the called-up capital minus call in arrears.

- Uncalled Capital: That portion of the subscribed capital which has not yet been called up. As stated earlier, the company may collect this amount any time when it needs further funds.

Accounting for Share Capital

- Reserve Capital: A company may reserve a portion of its uncalled capital to be called only in the event of winding up of the company. Such uncalled amount is called ‘Reserve Capital’ of the company. It is available only for the creditors on winding up of the company.

Let us take the following example and show how the share capital will be shown in the balance sheet. Sunrise Company Ltd., New Delhi, has registered its capital as Rs. 40,00,000, divided into 4,00,000 shares of Rs. 10 each. The company offered to the public for subscription of 2,00,000 shares of Rs. 10 each, as Rs. 2 on application, Rs.3 on allotment, Rs.3 on first call and the balance on final call. The company received applications for 2,50,000 shares. The company finalised the allotment on 2,00,000 shares and rejected applications for 50,000 shares. The company did not make the final call. The company received all the amount except on 2,000 shares where call money has not been received.

The above amounts will be shown in the Notes to Accounts of the balance sheet of Sunrise Company Ltd. as follows:

|

Notes to accounts |

||

| Share Capital |

(Rs.) |

|

| Authorised or Registered or Nominal Capital:

4,00,000 Shares of Rs. 10 each |

40,00,000 |

|

| Issued Capital

2,00,000 Shares of Rs. 10 each |

20,00,000 |

|

| Subscribed Capital

Subscribed but not fully paid up 2,00,000 Shares of Rs. 10 each, Rs. 8 called up Less: Calls in Arrears |

16,00,000 6,000 |

15,94,000 |