Preparation of Cost Sheet Tenders and Quotations

12/05/2021 1 By indiafreenotesIt is often seen that the management has to quota prices in advance in relation to goods to be supplied in future. For this purpose, an estimated cost sheet is prepared to show the estimated cost of products to be manufactured. While preparing the estimated cost sheet the cost of direct materials, direct wages and overheads are estimated on the basis of past cost structure after taking into account the present conditions and also the anticipated changes in future price level.

Tenders for Different Product:

When the tender or quotation price is to be ascertained for a different product, the cost of direct material, direct labour and other direct expenses will be estimated. The total of these will be prime cost Works’ overheads, office overheads and selling overheads will be added there to on the basis of absorption rates. Normally works overhead is charged or absorbed on the basis of percentage of works overhead on wages. Thus, percentage is calculated on the basis of past records.

Generally, production cost is ascertained after the completion of production work. But sometimes it becomes necessary to ascertain the production cost before commencing the production work. For example, a contractor will have to estimate his contract cost before commencing the contract work.

Often, the manufacturer is required to quote the estimated price by adding some profit for getting the orders from customers. Such estimated price is known as ‘Tender price or Quotation price’. Tender or quotation price is a price at which the manufacturer is ready to supply his goods to the customers.

Generally, this price is fixed after considering various factors such as:

(i) Past cost figures

(ii) Variations in cost in the current period

(iii) Expected margin of profit and

(iv) Number of competitors in the field.

Since the lowest tender price is accepted by the intending buyer, the manufacturer has to carefully consider all the above factors. A slight difference in calculation of the tender price may result in losing the tender.

Hence, the following items are to be analysed while preparing the tender:

- Direct materials

- Direct wages

- Factory overheads

- Administrative overheads

- Selling and distribution overheads, and

- Expected profit

An estimated cost is taken as the basis for fixing the tender price; it has to be developed on the basis of present costs with due regard to likely changes in the ensuing period to which they are to be applied.

The general procedure of estimation may be summarised as follows:

- Direct Materials:

The cost of direct materials can be estimated by multiplying the quantity required for a unit of output by the probable purchase cost of materials. Purchase cost of materials will be estimated in the light of future changes in market conditions.

- Direct Wages:

It can be estimated on the basis of job requirements and anticipated changes in wage rate.

- Overheads:

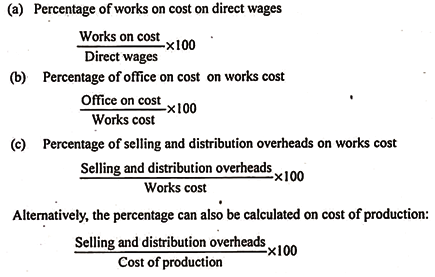

The amount of overheads is to be estimated on the basis of past experience as a percentage as given below:

Calculation of percentages on the basis of past records

Work overheads Rate = (Work overheads/Wages) *100

It may be alternatively charged on the basis of Machine Hour Rate or Labour Hour Rate. Office overheads may be absorbed on the basis of percentage of office overheads on works cost or works overheads

Office Overheads Rate = (Office Overheads/ Work costs or Work overheads) *100

The total of Prime Cost plus absorbed works overheads and office overheads will be Cost of Production. Selling overheads, if any, may be added there to on the basis of its absorption rate. It may be a percentage on cost of production or sales or at selling overheads per unit. By adding desired profit. Tender Price or Quotation Price will be known.

- Estimation of Profit for a Tender or Quotation:

The tender price is determined after adding the amount of profit to total cost. Generally, instead of giving the amount of profit, the percentage of profit is given in the questions. On the basis of such percentage, the amount of profit is determined.

The following two conditions may be possible:

(a) If the expected profit for a tender is given as a percentage of cost:

Profit = (Total cost*Percentage of Profit)/100

(b) If the expected profit is given as a percentage of selling price of the Tender:

Profit = (Total cost*Percentage of profit on Sales)/ (100- Percentage of profit on Sales)

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- More

[…] VIEW […]